The professional trade community heaved a collective sigh of relief when the United States published its “Summary of Objectives for the NAFTA Renegotiation.” After getting through the preamble, it was business as usual in trade negotiations — the main text addressed whittling away at non-zero tariffs (including the acknowledgement that some of the cuts would be to US tariffs); modernization to catch up with the technical provisions in texts such as the recently concluded Trans-Pacific Partnership (TPP) agreement; and a familiar laundry list of “irritants” for US stakeholders. Its tune was familiar and sounded like an invitation to a well-rehearsed jam session.

But what to make of the preamble, which featured pithy phrases such as “stop the bleeding,” “truly fair trade,” “addressing America’s persistent trade imbalances in North America,” “reciprocal market access” and “reciprocal and balanced trade among the parties”?

Preamble, Text and Subtext

The United States Trade Representative (USTR) text is grounded in rules-based trade: trade agreements establish an enabling framework but leave it to the private sector to decide what trade actually takes place. The White House preamble, by contrast, is grounded in mercantilism, which holds that exports are good (because they create jobs) and imports are bad (because the work goes to the foreign country). Accordingly, running a trade deficit “bleeds” jobs. The White House takes this at least three steps further than most mercantilists.

- First, it focuses on the US goods trade deficit. This means that it is not just a question of how much the US exports, but also the composition of those exports — goods versus services or asset-based income, such as earnings on investments abroad or royalties and license fees for intellectual property. The reason for this is the explicit concern about industrial jobs.

- Second, the reference to “reciprocal and balanced” trade implies a quasi-barter version of mercantilism, since trade must be balanced with each trading partner if it is to be fair.

- Third — reading this text in conjunction with the speeches of Peter Navarro, the White House’s trade policy director — it appears the White House equates capital inflows into the United States, which are a necessary consequence of a trade deficit, as “conquest by purchase.”

Reciprocal, balanced trade is not the way the world works.

First, countries do not trade — firms do. Thus, national trade balances emerge from the independent market strategies of millions of firms — domestic and foreign — competing for individual sales, and from the independent decisions of hundreds of millions of consumers — domestic and foreign — choosing from the menu of options in the global shopping mall. The trade balance chips fall where they may.

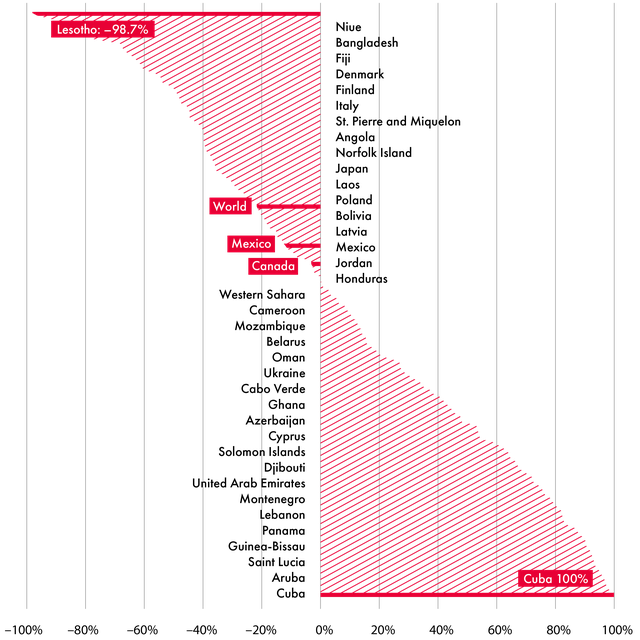

Figure 1 shows the implications of this for US bilateral goods trade balances. It depicts US net goods exports to each partner as a share of two-way goods trade with that partner. Thus, if the United States only exports to a partner, the share is 100 percent; if the United States only imports, the share is –100 percent. The data shows that in the last five years the United States has perfectly balanced its trade only once, with one country: Mayotte, a tiny island in the Pacific. The reason that trade was balanced in 2016 in Mayotte’s case is because there was no trade — zero for zero. Otherwise, there is an imbalance with each and every partner, ranging from a 100 percent surplus with Cuba, to a deficit of –98.7 percent with Lesotho. That’s the way the cookie crumbles in multilateral trade. Canada and Mexico are two of the least unbalanced trade relationships the United States has — but, as the figure illustrates, this is neither good, bad nor indifferent — it is simply meaningless.

Figure 1: US Net Exports as a Share of Two-way Trade by Partner, 2016

Second, headline bilateral balances do not translate meaningfully into job impacts. For example, the United States has trade surpluses with the Netherlands and Belgium because their ports are the first points of entry to the European Union, not because the United States is doing exceptionally well in selling goods to the Belgians and the Dutch. Similarly, a significant portion of the US trade deficit with China reflects China’s role in assembling intermediate products that were manufactured in other countries — including the United States itself. Moreover, in the modern knowledge-based economy, the most important inputs into goods exports are often services and intellectual property — not industrial labour.

Third, since it is firms that trade, how is one to assign responsibility at the firm level for any particular aggregate outcome? For example, some US firms only export to Germany. Others only import from Germany. There is no rhyme or reason as to why the importers’ purchases should be contingent on the exporters’ performances — or considered a manifestation of “unfairness.” Putting pressure on individual US firms to go against their own commercial interests — for example, by naming them and threatening punitive tariffs — puts them at a disadvantage to other US firms, never mind foreign competitors.

Finally, it is ironic that the US goods trade deficit is the source of such ire. In 1997, when Fred Bergsten and Jeffrey Schott offered an evaluation of NAFTA before a Congressional committee, they argued that the agreement should not be evaluated simply on the basis of the impact on trade and investment flows. Rather, it should also reflect seven strategic objectives, mainly related to Mexico, one of which was to to shift US imports from East Asia to Mexico, because these include more US content and because Mexico spends much more of its export earnings on imports from the United States. As many economists have pointed out, the US global trade deficit is not determined by trade policy — neither that of the United States nor of its partners. Instead, it is determined by the balance of US savings and investment. Squeezing the trade surplus from Mexico will simply shift it to third parties — most likely East Asia.

As regards the US global trade deficit, since the 1980s, US savings have failed to cover its investment and hence the United States has been a net importer of foreign capital. Three key factors contribute to this state of affairs:

- US fiscal policies — in particular, tax cuts in the face of fiscal deficits. The US structural fiscal deficit for 2017 is estimated by the International Monetary Fund (IMF) to be US$777 billion. This is substantially greater than the IMF’s estimate of the 2017 US external deficit of US$523 billion. The United States could counter the “conquest by purchase” simply by accepting the taxes required to finance its fiscal expenditures.

- The role of the US dollar in international financial transactions. The US dollar is on one side of 88 percent of all foreign currency transactions, most of which do not involve US parties themselves. This drives foreign demand for liquid US-dollar-denominated assets (such as cash and Treasury bills). The United States has a revealed preference to meet this demand by buying more from the rest of the world than it can support by exporting. The resulting capital inflows are not “conquest by purchase,” but a global gift to the United States, which is the basis of its “exorbitant privilege” of being able to transact international business in its own currency, without facing currency risk. The United States would not be happy to lose this privilege.

- Exchange rate instability. This drives demand for currency reserves, which in turn drive dollar hoarding abroad. Since the Asian/emerging markets crisis, which struck in 1997, developing countries have switched en masse from being net borrowers to being net lenders, in order to self-insure against currency instability by maintaining sufficiently large stocks of foreign currency reserves. The United States could readily remove this incentive for excessive savings abroad by making the US dollar a stable anchor for the global monetary system rather than a wrecking ball. But doing so would eliminate a huge profit centre for Wall Street, and hence the system persists.

The bottom line is that trade balances — bilateral or global — have little to do with trade policies or trade agreements. By the same token, the preamble and text in the USTR statement of the US objectives for renegotiation are not — on the face of it — mutually coherent.

Nonetheless, US trade negotiators, working in the context of the detailed text, will be under pressure to bring home a result that they can claim delivers on the preamble. How are they to achieve this? In other words, what is the subtext to the US statement of objectives that squares the preamble with the text?

In the context of the NAFTA renegotiation, an expansion of the US share of NAFTA-oriented production, while nominally advancing a traditional trade agenda, can be pursued in the following ways:

- obtaining a disproportionate dismantling of remaining Canadian and Mexican protection;

- adjusting NAFTA rules of origin to increase the amount of trade diversion from third parties and, more worryingly for Canada and Mexico, the amount of non-US-based value-added that can be incorporated in US-bound exports under NAFTA preferences; and

- expanding the effective protection provided by US trade laws, by removing both the ability of Canada and Mexico to challenge US application of its trade remedies under NAFTA's Chapter 19, which provides for review by a binational panel, and the NAFTA exemption from US global safeguard provisions.

Logically, this is where US trade negotiators will go. The negotiations are promised to be short and swift (seven rounds in half a year), but the Trump White House has, through its rhetoric, introduced conflict into international trade relations — and this is a problem.

As Republican Senator Jeff Flake has commented regarding Trump’s negotiating tactics, in his recent book Conscience of a Conservative, “Once you introduce conflict, you cannot de-escalate conflict. You must continually escalate.”

Thus the game of trade zones begins.