In the coming days, finance ministers and central bank governors from 188 countries will gather in Washington, DC to discuss their assessment of the global economy. Their attention will be on the US government shutdown and the (highly theoretical) prospect of a US default, rather than an imminent breakup of the euro zone. Risks of fallout of the euro have significantly receded, at least in the shorter term. Nonetheless, the policy narrative that the European delegations will share in Washington — centred on an imminent recovery and progress on fiscal stabilization and the banking union — should be met with caution.

Italy is an example: it is the ninth-largest economy in the world, the fifth-largest manufacturer and has the third-largest bond market. Most importantly, it bears the highest public debt relative to GDP in the entire euro zone after Greece, and one of the most fragile political systems. As a result, its policy actions or slippages may have far-reaching consequences well beyond its crisis-ridden national economy.

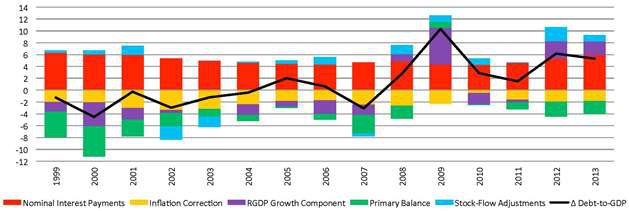

In summer 2011, Italy’s bond yield skyrocketed to over six percent when markets realized the crisis of a few peripheral economies of the euro zone had evolved into a systemic crisis of the single-currency area. By that time, Italy’s debt-to-GDP ratio was considered unacceptably high at 120 percent. In 2013, following a significant fiscal consolidation, its debt ratio exceeds 130 percent, even though its budget is close to being balanced in structural terms. What went wrong?

Despite the implementation of a consolidation plan in 2012, Italy’s public debt sharply increased by 6.2 percent of GDP, of which 3 percentage points were due to a contraction in the economy (Figure 1). In 2013, a shrinking economy is expected to contribute an additional 2.3 percentage points to another rise in debt-to-GDP by 5.3 percent. In total, economic contractions added 5.3 percentage points to the debt ratio in 2012 and 2013, yet the primary surpluses in the same period were not sufficient to offset the negative contribution of GDP, only counteracting the rise in the debt ratio by 4.7 percentage points. Lacking substantial structural reforms, with sluggish, or even flat, growth rates in the medium term, it will be some time before Italy’s fiscal position returns to pre-crisis levels, if at all.

Thus, in the absence of sound growth prospects, the ability to sustain the debt stock rests on two favourable scenarios: sizeable primary surpluses and a not-too-unfavourable interest rate environment. Both could, however, sharply deteriorate if the economy fails to reach a sustained growth path.

Growth, Ratings and Risks

The general opinion of credit rating agencies is that, notwithstanding notable accomplishments in the fiscal domain, Italian policy makers have done little to tackle long-standing structural impediments to ensure sound growth prospects.

Their assessment is relevant because official ratings serve as a reference point for underlying risk in a throng of market transactions, contracts and government regulations. Domestic and international regulatory regimes require financial institutions to hold capital relative to the risk of their asset holdings. Finally, the margining rules applied to pledgeable collateral used in the refinancing operations of the European Central Bank (ECB) and of other monetary authorities, and in private market-based financial transactions, are also influenced by official credit ratings. Italy’s large stock of outstanding debt combined with low potential (and actual) GDP growth has kept its rating consistently below that of other major advanced economies. Italy entered the global financial crisis with a credit rating on the upper end of the “A” scale by Standard & Poor’s (S&P). Then, the eruption of the euro-zone crisis in 2010-2011 precipitated a string of downgrades by all major credit rating agencies, bringing the country precariously close to losing market access. Subsequently, however, the announcement of the ECB’s potentially unlimited bond purchases (outright monetary transactions) program in the summer of 2012 brought about a gradual decline in bond yields, providing the country with some relief, despite further downgrades. But this may have generated a false sense of complacency that access to markets may have become less dependent on ratings decisions. If this is true, it would be an unforgivable mistake.

Italy has, in fact, gotten dangerously closer to the lower end of investment grade ratings that markets assess against — a grade below BBB- by S&P and Fitch, Baa3 by Moody’s and BBB (low) by DBRS. Currently, its credit rating still stands slightly above “junk” grade status. However, the country’s credit outlook is uniformly “negative” implying the likelihood of further downgrades. Indeed, any rating decision that would precipitate Italy’s sovereign ratings into “junk” grade area, or any expectation thereof, could trigger a sell-off of government bonds. Interest rates would soar, escalating pressure on the budget and eroding the primary surplus. Debt sustainability would be compromised. Significant spillovers to the global financial system would then ensue.

Without meaningful improvement in growth prospects, Italy will likely struggle to accomplish little more than treading water. Any failure to achieve even modest structural reforms will lead to a further downgrade. The critical question remains whether the Italian political system can finally coalesce around a comprehensive package of structural reforms. Given the current fragility in the majority coalition, chances look rather slim.

Works Cited

IMF (2013a). World Economic Outlook Database. April. Washington: IMF.

IMF (2013b). Italy: 2013 Article IV Consultation. IMF Country Report No. 13/298. Washington: IMF.