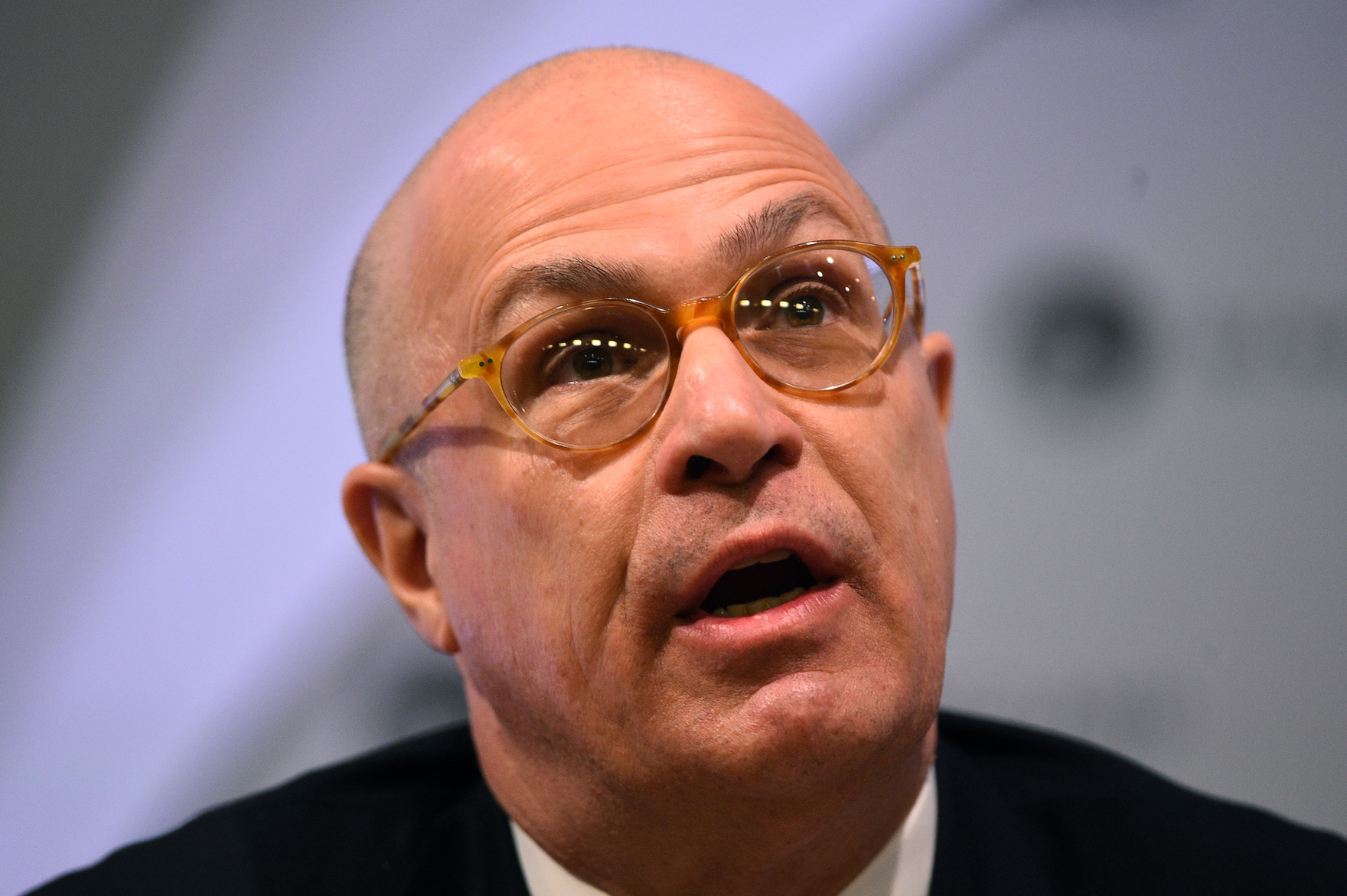

In the world of cryptocurrency, where hipster techno-geeks predominate, J. Christopher Giancarlo stands out for his adult demeanour and establishment background. A graduate of Vanderbilt University Law School and a Republican who spent much of his career as a corporate attorney, Giancarlo chaired the US Commodity Futures Trading Commission during the Trump administration. Notwithstanding those power-elite credentials, he attained celebrity status among bitcoiners — who dubbed him “CryptoDad” — when, in 2018, he engineered approval for trading bitcoin futures contracts and lauded the youthful exuberance of monetary innovators. After leaving government and joining a major international law firm, he continues to play an influential role in the cyber-money realm as co-founder of a non-profit initiative called the Digital Dollar Project.

Now Giancarlo has expounded his views in the new book CryptoDad: The Fight for the Future of Money, which will undoubtedly carry weight in the policy debate over the intersection of finance and technology, given his stature, clout and experience as a top regulator. But readers should beware. This book is infused with the mindset of overindulgent parenthood.

Giancarlo refers often to the inspiration he draws from the dynamism and creativity of the crypto community, and as the book’s title suggests, he revels in the veneration he has received. Recounting the episode that earned him his moniker, a February 2018 hearing of the United States Senate Committee on Banking, Housing, and Urban Affairs, he cites the testimony he delivered, which began on a personal note: “I’m the father of three college-age children….Suddenly, they’re all talking about Bitcoin,” he told the senators. “They are asking me what I think and should they buy it. One of their older cousins who owns Bitcoin has been talking about it and has got everyone excited.” Although it was necessary to “crack down hard” on fraud and manipulation, he continued, “It strikes me that we owe it to this new generation to respect their enthusiasm about virtual currencies with a thoughtful and balanced response, not a dismissive one.”

Even as he spoke, “my Twitter account was exploding, gaining thousands of followers by the minute,” Giancarlo writes, as the hashtag #cryptodad was born — his apparently favourite indication of the chord he had struck. “My remarks were celebrated by virtual currency fans around the globe who Photoshopped my likeness into dozens of online images and videos.”

Giancarlo’s solicitude toward crypto enthusiasts is commendable in one important respect. All too often, they are accused of base motives — of perpetrating a Ponzi scheme for reasons of sheer greed, when in fact many are idealistic and convinced that widespread crypto adoption will make the world more just, free and peaceful. The zealots among them believe that the global financial system is rotten, that commercial banks defraud savers by keeping only a fraction of deposits in reserve, and that the US Federal Reserve prints excessive amounts of dollars to finance American military adventurism. A common argument for holding bitcoin is that because its supply is capped — the software governing it is designed to halt its creation after 21 million bitcoins are put into circulation — it is a superior form of money to “fiat” currencies that are doomed to lose their value to inflation.

A different father figure, benevolent but responsibility-minded, might tell his flock that, superficially attractive as those views may seem, they are misguided, lacking in knowledge of economics and based on outlandish conspiracy theories. Such a parent might explain, for example, that it’s essential for modern economies to have elastic currencies, which central banks can issue in sufficient quantities to accommodate growth in productive output while maintaining reasonable price stability — no easy task, but far preferable in most countries to a rigidly limited money supply.

Giancarlo isn’t that type of dad; he leans toward the “That’s awesome!” approach to parenting, at least when it comes to crypto. “Something big is going on…a change that comes not once in a generation, but perhaps once every few centuries,” he writes. “This change is being driven by a new wave of the Internet — the Internet of Value — that permits the instant transfer of things of value over the worldwide Web directly from person to person without the need for intermediaries.” As for worries that soaring cryptocurrency prices are akin to the seventeenth-century mania for tulip bulbs, he acknowledges the criticism but dodges it, as witnessed by this excerpt from Senate testimony, which, he tells readers, stirred a particularly frenzied response on social media:

What we hear a lot of is people buying and holding. If you — if you go on to the Twitter universe, you’ll see a phrase HODL, which means hold on for dear life….In fact, I mentioned in my opening remarks, my 30-year-old niece who bought Bitcoin years ago, and she’s a HODL. She says “I’m going to own it, I don’t know what’s going to come of it but I want to hang onto it.” And she’s not a fraudster or a manipulator, she…just believes in it….And I think she represents a lot of folks that think there’s something in this, I want to hold onto it.

As might be expected, Giancarlo favours regulatory restraint in the crypto space. Regulators should embrace a “First, do no harm” approach, he contends; the overarching goal should be “fostering healthy development of crypto innovation, well ordered crypto trading markets and their contribution to the modernization of the existing financial payment system to make it less exclusionary and more accessible, less costly and more dynamic for all Americans.”

Hard to argue with such high-minded sentiments. But what about crypto’s dark side? A glaring example is ransomware attacks — the blackmailing of companies and public institutions by criminals who threaten to disrupt computer networks or expose sensitive data unless their owners pay massive sums — which have proliferated in recent months, thanks to the identity-masking properties of bitcoin and other digital money networks.

Giancarlo suggests that such problems are being exaggerated. “By 2020, the criminal share of all cryptocurrency activity fell to just 0.34%, or $10.0 billion in transaction volume,” he writes — a convenient statistic for playing down the severity of the issue, since gambling and speculation on crypto have grown so explosively as to make the illegal malefaction seem puny by comparison.

He also opposes the widespread calls for combatting crypto-using crooks with much tougher enforcement of KYC or know-your-customer requirements on financial institutions and other money transmitters. He notes that in countering money laundering and tax evasion, KYC “is highly inexact yielding a preponderance of false positives.” Fair enough, but here’s Giancarlo’s alternative: “We must find more effective ways to counter illicit financial activity. An answer may be found in new technologies of big data analysis, automated pattern recognition and artificial intelligence.” Let’s hope so, but let’s also hope regulators will take full advantage of the tools they have while waiting for those new technologies to be fully developed.

To be fair, Giancarlo is hardly a crypto “maximalist.” He wants and expects central banks, in particular, the Fed, to develop digital versions of their own fiat currencies, and his best insights come in his chapter about central bank digital currency (CBDC). He frets about the lead that China has taken on CBDCs — a common fear, and an overwrought one, as I have argued. But he makes an eloquent case for the careful design of a US CBDC, so as to protect users from government snooping or interference in spending decisions.

“What if [money-issuing agencies] could surveil or restrict your ability to support political candidates and causes they disapproved of or activities and pastimes they disfavored?” he writes. “What if you were prevented from donating to advocacy groups for such causes as LGBT+ rights or second amendment freedoms depending on your point of view?….If we want to prevent a small group of technocratic and government elites, however enlightened their intentions, from consolidating power over the rest of us, the answer must be ‘hands off.’” Offering the book’s most compelling defence of crypto, he adds that “the best protection against impermissible government surveillance of economic activity or restrictions on otherwise lawful transactions may be robust competition” from non-fiat money.

His main message is well worth heeding: “Money is too important to be left to central bankers. You and I must assert a voice in the rapidly coming change in money.” If only he had added that money is also too important to be left to the fantasies of hipster techno-geeks.