Key Points

- Large multinational enterprises (MNEs) are shifting their innovation strategies away from a long-standing habit of centralizing their research and development (R&D) operations close to their home base, and starting to tap into regional sources of expertise in host countries, in the hope of increasing their competitive advantage.

- This strategic shift has potential implications for Canada’s traditional weak performance in business sector R&D, where the dominant role of global companies in key sectors has been seen as a major contributor to this underperformance.

- While not yet fully captured in the current R&D data, recent indications from both quantitative and qualitative sources suggest that the proportion of business R&D performed by foreign-controlled performers is beginning to shift in relation to domestic performers as global companies are trying to leverage Canadian research capabilities in critical emerging technologies.

- This shift poses two related challenges for Canadian innovation policy. Continuing to attract MNEs to invest in Canada with substantial tax incentives or direct subsidies may be an inefficient use of scarce public resources. Past investments in building the research capabilities and talent base of Canada’s innovation infrastructure appear to provide a more effective inducement to attract new investments by MNEs and to anchor existing MNEs in the national economy. However, great care must be taken to ensure that the talent base is kept in Canada. A more judicious use of limited public funds might be to devote them to the support and growth of indigenous Canadian technology firms that the MNEs want to partner with and that have the potential to compete in global markets.

here are increasing signs that large global companies may be shifting their innovation strategies away from a long-standing habit of centralizing their R&D operations close to their home base, and starting to decentralize their innovation activities by tapping into regional sources of expertise in host countries, in the hope of gaining competitive advantage.

If it persists, this emerging trend toward creating a geographically diverse global network of research hubs — each embedded in its own local innovation clusters — has significant implications, not just for business strategy, but for the host countries and regions, such as Canada, that are attempting to accelerate their knowledge-based economies by attracting international investment in higher-value-added activities.

A substantial body of research attributes Canada’s innovation underperformance to the predominant role played by MNEs in the R&D-intensive sectors of the economy, especially manufacturing.

Evolving Perspectives on Policy and Performance

Canadian innovation policy has long been concerned with the impact of the MNE on Canadian R&D and its success or failure in innovative performance. A substantial body of research attributes Canada’s innovation underperformance to the predominant role played by MNEs in the R&D-intensive sectors of the economy, especially manufacturing. This perspective was reflected in the work undertaken by the Science Council of Canada in the 1970s and 1980s, but has been more recently echoed in detailed assessments from the Council of Canadian Academies (CCA), notably in its path-breaking report Innovation and Business Strategy: Why Canada Falls Short (2009). However, current research on international business strategy suggests that the relationship between MNEs and the global production networks through which they coordinate activities may be changing the calculus by which MNEs view their investment strategies in host countries. MNEs appear to be restructuring their local operations in host countries, shifting their emphasis from customizing global products for local tastes to sourcing R&D globally. To better understand Canada’s innovation performance, two critical questions must be considered: is this shift occurring in Canada, and if so, what are its implications for Canadian research and innovation policy?

Foreign Enterprise and Canadian R&D

For decades, the role of foreign enterprise in the Canadian economy has been a subject of contention, and its relevance for R&D activities is of particular significance. The ratio of R&D spending to GDP in Canada is lower than in other industrial nations, including the United States, Japan, Sweden, Belgium and the Netherlands. The impact of Canada’s legacy of foreign control in manufacturing is still hotly debated in the literature on innovation and technological change. Much of the debate revolves around the effect exerted by foreign ownership on the innovative capability — both product and process — of Canadian manufacturing. Critics, such as the Science Council of Canada, hold that foreign-owned firms underperform R&D in their Canadian operations, relative to Canadian-owned firms in the same industry. They also claim that such firms focus on the production of relatively mature products in their Canadian plants. Other observers, such as Kristian Palda, take the position that foreign-owned firms have raised the technological standard of production processes in Canada by acting as important sources of advanced manufacturing technologies, which they have implemented in their Canadian operations (Palda 1993, 126).

Despite the increasingly global nature of technological activities, national differences among the leading industrial countries remain significant, and the specific character of the national economy is crucial to the domestic firm’s innovativeness.

The Canadian case fits well within the context of a broader debate over the globalization of technology, which centres on the questions of how specific national or regional contexts affect the process of innovation and technology diffusion, and what their implications for policy might be. Despite the increasingly global nature of technological activities, national differences among the leading industrial countries remain significant, and the specific character of the national economy is crucial to the domestic firm’s innovativeness. Researchers have asserted that multinational firms, too, continue to maintain a strong home base — where they perform the bulk of their R&D — in their country of origin. In this scenario, the foreign operations of such firms might support innovative activity, but it is more likely to be confined to the customization of existing technologies to suit the tastes or unique conditions of local markets. Accordingly, one would expect to find a heavy emphasis on marketing, close-to-market development (rather than full-fledged R&D) and strong local relationships with customers rather than with suppliers or potential research collaborators. The importance of linkages to science-intensive local or regional universities and public research labs would logically be less for such foreign-owned firms than for their domestically based counterparts. Overall, these studies suggest that the role of the home country and its individual policies is not reduced as a result of globalization (Gertler, Wolfe and Garkut 2000). Notwithstanding the globalization of markets and production, there remains a compelling reason why companies continue to concentrate their technological activities at home.

These themes in the international literature resonate with the analyses presented in a number of background studies carried out by the Science Council of Canada in the 1970s and 1980s. Particularly noteworthy was John Britton and James Gilmour’s The Weakest Link: A Technological Perspective on Canadian Industrial Underdevelopment (1978). Britton and Gilmour showed that Canadian subsidiaries of foreign firms largely depended upon the transfer of mature industrial and product technologies from their parent companies. As a result, Canada was a recipient in the international technology transfer system and, for the most part, domestic firms depended on this imported technology or were imitative of it. Small domestic firms in the Canadian economy were constrained by their limited capacities and the lack of support they received from public purchasing or procurement and investment. An additional consequence of these factors was the overreliance of the Canadian economy on the production of manufactured goods that depended on mature product technologies.

Britton and Gilmour also suggested that Canada could improve its innovative performance by making greater investment in scientific R&D, but — given the limited incentives for technological development offered by the marketplace in Canada — this would be insufficient to overcome the technological deficit that the country faced. This innovation deficit implied the need for government action to regulate technology imports and to strengthen the bargaining power of Canadian firms when purchasing technology from abroad. The study concluded that technology policy in Canada needed to address both the demand and the supply side of “the Canadian innovation system,” in contrast to the traditional Canadian policy approach that focused on the generation of new knowledge without considering the linkages required to stimulate demand for new products.

Gains realized through improvements in traded goods and services would generate increased prosperity throughout the provincial economy.

Growing at Home to Reach World Markets

The report of the Ontario Premier’s Council, Competing in the New Global Economy, released in April 1988, introduced an important distinction into the debate over the performance of R&D in Ontario and Canada. The report distinguished between the roles played by indigenous and non-indigenous firms in Canada’s innovation performance. It portrayed international competition as the key to a high-wage economic strategy and improved standards of living. This strategy could best be pursued by focusing economic policies on traded businesses — those exposed to world trade and competition. Gains realized through improvements in traded goods and services would generate increased prosperity throughout the provincial economy. To achieve this goal, Ontario (and Canada) needed to increase the number of indigenous companies capable of competing effectively in global markets. Indigenous firms could be either MNEs or domestically owned; the critical variable was the extent to which they performed a high level of R&D in Canada and viewed the national economy as an export platform for competition in global markets, rather than as merely a sales outlet for products and technologies developed elsewhere. From the Council’s perspective, indigenous firms were more likely to provide higher-value-added jobs, generate indirect employment and create spin-off companies in the province. Ontario’s challenge was to accelerate the growth of indigenous firms in the traded sectors that had the potential to reach world-scale levels of activity (Premier’s Council 1988, 75).

Many of the issues hotly debated in the 1970s and 1980s seemed to fade into the background in the following two decades, after the adoption of the Canada-US Free Trade Agreement in 1989. The integration of Canada into the North American Free Trade Agreement in 1994 signalled the triumph of the more market-oriented perspective, which favoured a laissez-faire approach to the role of MNEs, over the more interventionist strategy of the Science Council or the Ontario Premier’s Council.

Over the past decade, however, as concern with Canada’s weak innovation performance has re-emerged, the issue of foreign control has received renewed attention. The CCA’s Innovation and Business Strategy report identified foreign control among Canada’s large firms as a key factor in lower business expenditures on R&D (BERD), but said that measuring its direct impact is complicated by other factors, in particular the overall effect of firm size and the propensity to perform R&D across different industrial sectors (CCA 2009, 101). US multinationals operating in Canada tend to be large and in R&D-intensive sectors, both of which correlate positively with R&D on their own. Given the size and role of MNEs in these sectors, they could make a greater contribution to Canada’s innovation performance if they behaved more like the indigenous firms described by the Premier’s Council.

Striving for “Dynamic Connectedness”

While the preponderant role of MNEs in critical sectors of the Canadian economy remains challenging from an innovation policy perspective, recent research on trends in international business strategy suggests that global MNEs might be recasting their R&D activities in host countries in a manner that could be beneficial to Canada. Relationships between subsidiaries in host locations and their parent MNEs have been shifting in recent years as subsidiaries have been given broader mandates to pursue “asset-seeking” or “asset-augmenting” strategies. In this approach, subsidiaries are granted greater scope to pursue competence-creating investment strategies, in the belief that the host location is not just a market for the home country’s products but also a potential source of competitive advantage for the MNE.

John Cantwell (2009) maintains that globalization and national specialization are complementary parts of the process and not conflicting trends. The trend toward organizing on a global basis is founded on the desire to tap into the locally specific and differentiated stream of innovation in each national centre. According to Cantwell, this view depicts “the MNE as an international network for geographically dispersed innovation” that stresses “the dynamic connectedness between local knowledge creation and exchange in each node of the network” (ibid., 36). This change involves a shift in the role of the MNE, from that of institutional mechanism for transferring new technologies across national boundaries to creator of new technologies in discrete national and regional jurisdictions.

As MNEs shift their innovation strategy to one of networked technology creation, they become more interested in producing in locations that provide access to complementary innovation capabilities.

For this strategy to succeed, the local subsidiary must become embedded in its own local network of research activity and competence building. As MNEs shift their innovation strategy to one of networked technology creation, they become more interested in producing in locations that provide access to complementary innovation capabilities. From the perspective of the firm, the goal is to link a range of high-value-creating activities across a number of different nodes or centres of excellence that collectively form the international network of the MNE, which results in the construction of an integrated portfolio of locational assets across a range of host countries or regions in which the MNE is embedded. This changing rationale for MNE investment involves a new strategy for corporate diversification in which the MNE can create greater value by linking a series of interdependent subsidiaries and research centres into an evolving range of complementary activity. There may also be a competitive rationale for industry-leading MNEs not wanting to locate their technology development activities in the industrial home base of their major competitors. The strategy of differentiating their regional sources of research expertise might also create the opportunity for new innovation and development strategies for the host economies in which the MNE is based. This could be particularly true in the case of new or emerging technologies at the core of the current information and communications paradigm that are not an area of research excellence for the MNEs’ home base (Cantwell 2017).

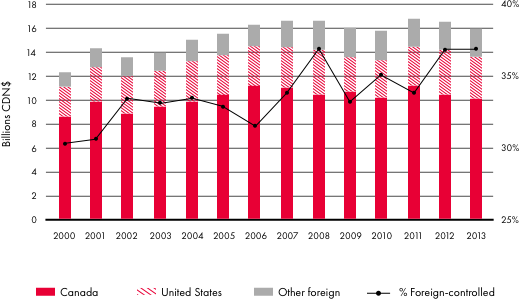

This emerging trend has significant implications for host economies, such as Canada, which have traditionally been the locus of high levels of foreign investment. Regional economies able to leverage their research assets and talent base have the potential to attract new forms of investment by MNEs interested in accessing “asset-augmenting capabilities” as a core element of their evolving innovation strategies. The trend also has the potential to alter the historical pattern in Canada of underperforming on levels of BERD. Analysis of recent trends in the data on MNEs’ performance of R&D in Canada suggests that just such a pattern may be emerging in this country. The data in Figure 1 provides initial evidence to support this view; there has been a noticeable increase in the foreign share of R&D performed in Canada over the past decade and a half.

Figure 1: In-house Industrial R&D Expenditures by Country of Control, 2000–2013

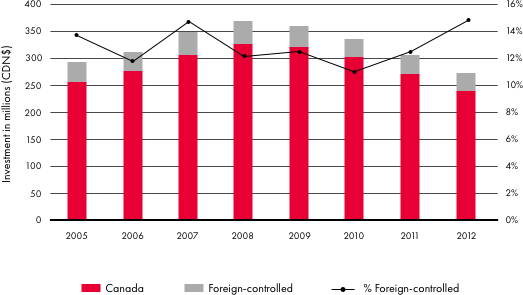

More recent data might provide further confirmation of this trend. Recent announcements by several MNEs with a strong presence in Canada signal a continuing shift in the corporate approach to investments in the domestic economy, especially in the auto sector. This trend is notable because the sector was identified in the CCA report as one of the critical manufacturing sectors with relatively little domestic R&D being performed by the “Big Three” who dominate it, despite the substantial proportion of North American vehicle production accounted for by Ontario. According to the current president of General Motors of Canada Company (GM Canada), Steve Carlisle, the Canadian industry must stop relying on technology developed elsewhere for the cars assembled here: “The way I think of it in real simple terms is we need to be inventing things to manufacture, not relying on manufacturing things that have already been invented” (Owram 2016). Announcements by GM Canada and other leading manufacturers over the past several years suggest this pattern is beginning to change, as they reassess their investment strategies in the host region. This development is in keeping with a broader trend in the changing relationship between MNEs and host regions described by Cantwell. The data presented in Figure 2 provides a preliminary indication of an increasing trend of automotive R&D in Canada.

Figure 2: R&D Performers in the Automotive Industry in Canada

General Motors, with a strong historical base in Ontario dating back to the early twentieth century, has recently announced a dramatic shift in its investment strategy in the province. In June 2016, the company announced a major new investment in its Canadian regional engineering centre in Oshawa, which will expand its current employee base to more than 1,000 positions in the next few years. Research at the expanded centre will focus on autonomous vehicle software and controls development, active safety and vehicle dynamics technology, audio and video “infotainment” systems and connected vehicle technology — all critical areas of R&D for the next generation of automotive technology. The plans exceed the capacity of the current Oshawa tech centre and so GM Canada has opened a new automotive software development centre in Markham, Ontario. In the words of Mark Reuss, GM’s vice president of global product development, Canada was selected as the site of this R&D expansion “because of its clear capacity for innovation, proven talent and strong ecosystem of great universities, startups and innovative suppliers” (GM Canada 2016).

Conclusion: Expanding Canada’s Innovative Capacity

The increased investment by automotive MNEs in Canada and Ontario’s R&D capacity is a response to the growing integration of the automotive and information and communications technology sectors of the economy. The corporate decision by a leading MNE to focus a significant portion of its future research in Canada is a reflection of the established strengths of the research capacity in this part of the country. While it would be precipitous to build an overall strategy around one corporate announcement, this development suggests the need to rethink our innovation strategies at all three levels of government. In light of recent announcements by federal, provincial and municipal governments of the creation of new investment attraction agencies, such as Toronto Global, as well as the emphasis placed on the importance of attracting more foreign direct investment by the minister of finance’s Advisory Council on Economic Growth (2016), this example contains critical lessons for the policy mandates of these new agencies. Looking at the outcomes of past strategies, evidence suggests that attracting MNEs to invest in Canada with substantial tax incentives or direct subsidies might be an inefficient use of scarce public resources. However, past investments in building the talent base and research capabilities of Canada’s innovation infrastructure appear to have provide a stronger and more effective inducement to attract new investments by MNEs to Canada and to anchor existing MNEs in the national economy. A more judicious use of limited public funds might be to devote them to the support and growth of emerging indigenous Canadian firms that have the potential to compete in global markets. There is reason to believe that this focus, combined with the outstanding capabilities of Canada’s research infrastructure, might prove to be the most efficient way to strengthen our domestic R&D base and future innovation potential.