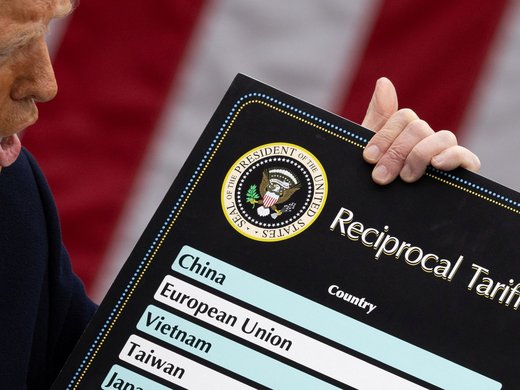

President Donald Trump’s “Make America Great Again” cross-border tariff battle shows no sign of abating.

Following months of duty hikes, threats and new tariffs, the Trump administration moved this month to escalate tensions once again — lobbing the idea of imposing a 20 percent tariff on all automobiles entering the United States from Europe.

Trump's comments, which emerged in typical tweet form, came shortly after the European Union installed new duties on $3.3 billion of US products, including iconic US companies such as Levi’s jeans, Harley-Davidson motorcycles and Kentucky bourbon. Facing export tariffs, Harley-Davidson subsequently decided to move jobs overseas, outraging the White House.

Of course, the European tariffs only emerged in late May, after US Commerce Secretary Wilbur Ross announced that existing steel and aluminum tariff exemptions for Canada, Mexico and the European Union had expired.

Mexico also hit back last month, announcing tariffs on $3 billion worth of US products including cheese and pork. Canada responded as well with a wide variety of tariffs, which took effect on July 1, Canada Day. An estimated CDN$16.6 billion in Canadian imports of US steel, aluminum and many other products, including yogurt, roasted coffee, orange juice, mayonnaise, detergent, toilet paper and more, are being hit with new taxes. The Canadian government argues that the tariffs would be equivalent, but there is no doubt that they are quietly anticipating the possibility of another escalation from the Trump administration.

Escalation and over-the-top assertions have been central to these recent changes in global trade. The United States justified its steel and aluminum tariffs based on an obscure and old trade law that purports to permit duties based on national security grounds. It’s been a key point of contention for both Canada and Europe.

Canadian Prime Minister Justin Trudeau called the national security reasoning for the tariffs “kind of insulting,” which prompted Trump’s trade adviser Peter Navarro to suggest that there was a “special place in hell” for Trudeau, comments he quickly apologized for.

The tariffs and retaliatory duties on US goods imposed by Canada and other countries offer a picture of the extremely messy web of trade that has emerged in recent weeks and months.

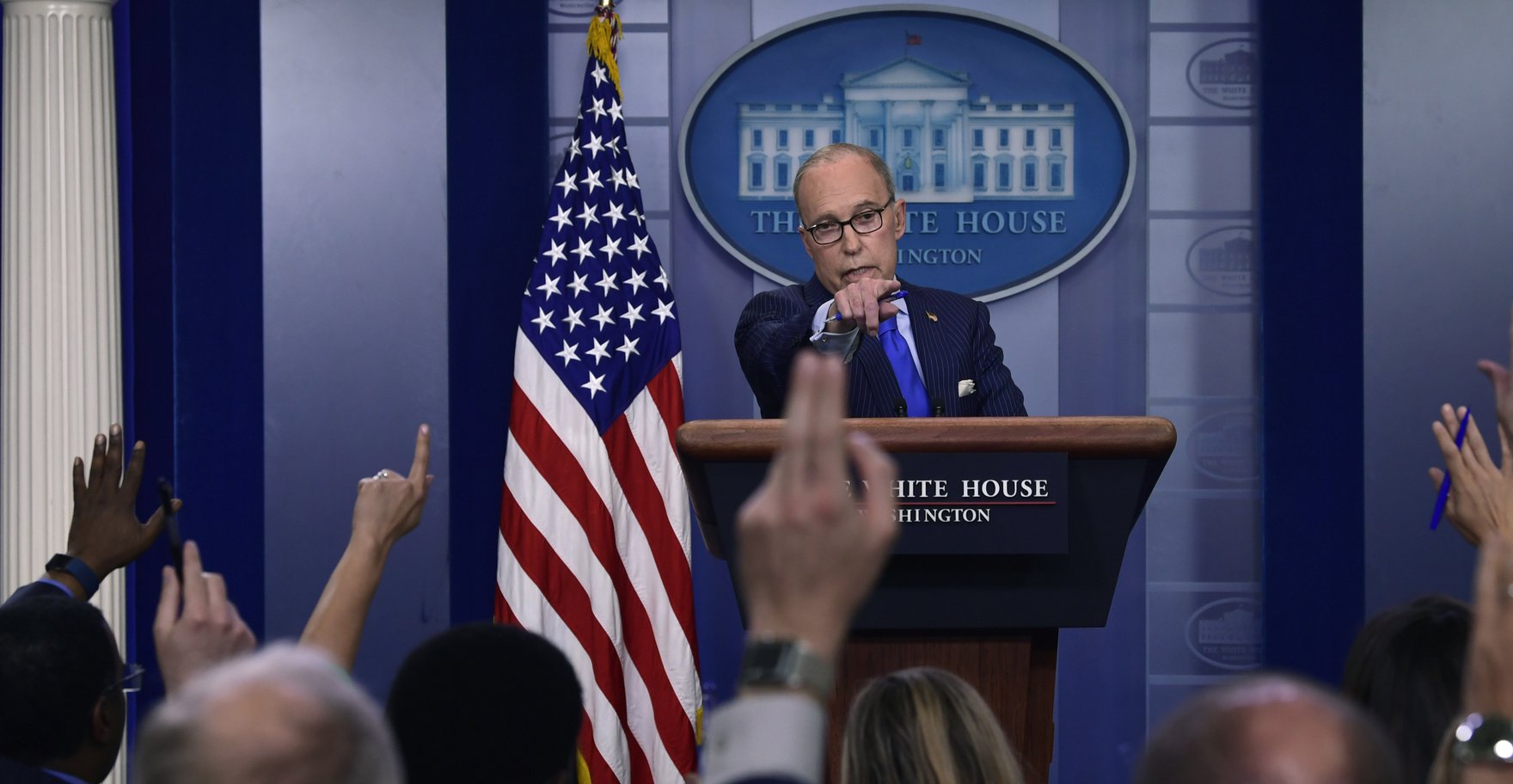

In the meantime, various jurisdictions prepare for the next round of tariff hikes —although it’s not clear what the Trump administration’s next move might be. Robert Scott, senior economist at the Economic Policy Institute in Washington, argues that the US approach to trade and taxes has been scattershot and incoherent, with no underlying plan.

“The Trump administration strategy is to issue a trade-related tweet daily, to present the appearance of action, but that covers up the fact that they don’t have a strategy for what they want to accomplish,” Scott said.

It is possible that a bombshell automobile import tariff could be next. In May, reports suggested that the Trump administration, citing national security risks, might impose a 25 percent tariff on all cars entering the United States, not just those from Europe. That kind of restriction would have a significant negative impact on Canada’s vehicle manufacturing industry, which sells more than 80 percent of cars to the United States.

For Scott, such a tariff, if ever implemented, would have a much bigger impact on Canada, which is much more dependent on trade and probably would not have the means to retaliate effectively.

“You might see some Canadian auto manufacturing plants shut down,” Scott said. “Such a tariff could drive auto assembly plants to move around, across borders, as a result.”

The tariffs, and threats of more, are likely being employed by the Trump administration to nudge the ongoing renegotiation of the North American Free Trade Agreement (NAFTA), into a direction it perceives as more United States-friendly. Talks have been going on for over nine months and are expected to continue into 2019.

The United States may be betting that its large economy will keep the country less sensitive to what Canada or Europe does in retaliation. In terms of tariffs, the possibility of lost jobs at US Harley-Davidson plants — among others — counters that argument. A number of US companies have already complained about tariff hikes on imports, including MillerCoors, the brewing parent of Miller High Life beer.

And the Canada-Mexico-European Union tariff battle comes as the United States is in the midst of a (potentially even more heated) battle over trade with China, one that is having far-reaching implications for major cross-border, multi-billion-dollar mergers as well. On June 15, the Trump administration listed the Chinese products it plans to impose tariffs on.

Scott notes that the initial list covers more than 800 high-tech products, including some semiconductor devices — a major category on the list — as well as equipment for making computer chips.

The magnitude of the US tariff on imports of Chinese-made computer chips and other high-tech products is slightly larger than the cost of tariffs on steel from all countries, but still less than one-tenth of one percent of the United States’ GDP, noted Scott. Semiconductor chips assembled as components into smartphones, such as those manufactured at China’s Foxconn, which makes Apple Inc. iPhones for export to the United States, wouldn’t be impacted, he said.

Altogether, the list includes duties covering $46 billion of imports from China in 2017, with a big chunk of those tariffs taking effect on July 6. Expect China to retaliate immediately, not just with higher tariffs on US exports to China, including agricultural products, but in the sphere of big corporate mergers.

China’s moves may be in retaliation to some actions the United States took recently on cross-border deals. An interagency panel of US regulators charged with reviewing cross-border deals for national security risk in March took what appears to be the unprecedented action of blocking a $79-a-share hostile bid by chipmaker Broadcom for San Diego-based Qualcomm Inc.

The US Committee on Foreign Investment in the United States (CFIUS) blocked the possible deal and suggested that it would have resulted in Qualcomm losing its leadership role in 5G standards-setting and thus creating an opening for China’s Huawei Technologies Co. Ltd. Broadcom was quickly moving to redomicile itself from Singapore to the United States to try and avoid CFIUS review, but the US government rejected the merger before that could happen.

The rejection — and continued escalation of tariffs by both countries — may also wreak havoc on a blockbuster merger that the United States wants to see completed, Qualcomm’s long pending $44 billion acquisition of Netherlands-based NXP Semiconductors. NXP has significant operations in China and has been awaiting clearance from Chinese regulators, who may be holding the deal hostage in hopes it can gain some leverage in other areas, including trade.

Another key consideration: earlier this month the Senate approved in a bipartisan manner legislation that would restore sanctions on China’s ZTE Corp., a Chinese smartphone and telecom equipment manufacturer, which comes after Commerce Secretary Ross earlier this month announced a deal to end the sanctions.

Should Congress approve the ZTE restrictions, it could put Trump in a difficult position, considering that the bill is attached to a must-pass defence authorization bill. A move to restore ZTE sanctions — considered in a climate of hiked tariffs imposed by both countries — could drive China to retaliate and block the Qualcomm-NXP deal.

In any event, one can consider government reviews and rejections of a massive merger to be part of a broader quid pro quo transatlantic approach to transactions, trade and tariffs.

“[President] Trump is an extraordinarily transactional person and seems to believe in a scorched earth policy when dealing with individual negotiations,” Scott said. “The idea is ‘I’m going to impose a tariff because I am the big US and if you put a tariff on me I’ll put one that is twice as large.’”