A previous post, here, highlighted the very low interest rates that prevail in the “waiting for Godot” global economy. These rates may reflect a post-crisis, paradox of thrift economy, with uncertainty about the future raising savings, driving interest rates down, and retarding investment. Historically low interest rates are indicative of savings in excess of investment. If the global economy was at or above full employment, we could be reasonably confident in saying that the problem was too much savings; with the global economy continuing to labour under a chronic insufficient global aggregate demand, the problem may be too little investment.

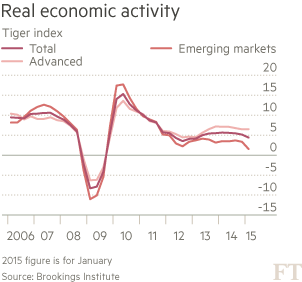

Regardless, the weak pace of global growth associated with these interest rates is worrisome. One bright spot in the immediate post-crisis period had been the relative strength of emerging market economies, which outpaced the advanced economies burdened by the overhang of financial excesses (Canada being a fortunate exception) and, in Europe, banking and monetary union troubles. But, as the Brookings-Financial Times Tiger index of global economic activity suggests, growth in the emerging markets has under-performed relative to the advanced economies (below). And risks to the outlook for emerging markets may be deteriorating. Weaker growth in the emerging markets would not, of course, be helpful to advanced countries.

These low interest rates also have a negative effect on advanced economies — Canadians included. In the prevailing low-growth, low-interest-rate environment, pension fund managers are engaged in a search for yield in order to generate the stream of payments needed to meet return requirements and ensure the pensions of Canadian retirees are honoured. At low interest rates, the discounted present value of future pension obligations increase. This can result in an unfunded position for pension funds, with the value of liabilities exceeding the assets held in the balance sheet.

Pension fund managers need long-lived assets to match the long-term nature of pension fund obligations, within acceptable risk limits of their investment mandates. Meanwhile, many emerging market economies are seeking to greatly increase investment in public infrastructure.

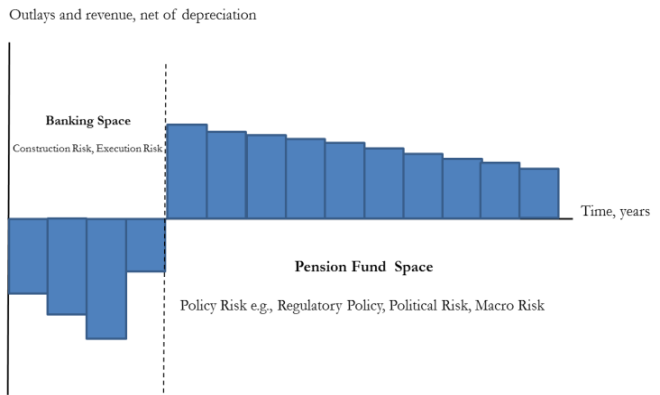

Although there are potentially large gains from bringing these parties together, certain aspects of infrastructure investment, together with potential policy risks, block mutually-beneficial transactions. Most significant, are project construction and execution risks. These risks are paramount in the early stages of the project, as the infrastructure project is under construction. Once the project is completed, however, it begins generating an income stream that extends over a very long period. At this point, the financial viability of the project is subject to unexpected changes in the regulatory framework or the macroeconomic environment.

The life cycle of a hypothetical infrastructure project is shown in the figure below.

Life Cycle of Infrastructure Projects

Net cash flows are not only negative in the early life of the project, but the probability distribution of expected outlays is skewed: there are far more things that can go wrong and raise construction costs, or derail projects altogether, in the initial phase of the project than potential cost savings. In contrast, on completion, risks are two-sided with possible upside and well as downside risks. The risks associated with infrastructure projects reduce their attractiveness to pension fund managers.

The Role of the IFIs

The challenge is to identify how these impediments to successful contracting can be overcome. The international financial instruments that provide financing while taking and sharing risks in the construction phase and bridge to the ‘take out’ by long-term institutional investors (pension funds and life insurers) after completion of the project could unlock resources and facilitate infrastructure investment. Financial instruments and options that could be deployed to address these problems include guarantees, debt subordination/first loss arrangements and other equity investments, as well as mezzanine financing arrangements.

The prospective consolidation of the private sector windows of the IDB group should improve policy coordination and create economies of scope/scale that expands the set of bankable projects and which strengthen the primary market both directly through filling project-specific gaps, and indirectly by bridging in institutional investors and strengthening a secondary market. Moreover, such innovative financing arrangements would allow development banks to recycle their balance sheet more frequently, increasing the efficiency of shareholder capital. Instead of financing one project, say, with a standard 20-year investment loan, a dynamic private sector lending institution could use new products to finance four projects over the same 20 year period with the same capital.

Host governments

Uncertainty regarding policy frameworks can also block pension fund investment in infrastructure projects in the region. This uncertainty might reflect the potential for political interference in the pricing of the service or in the arbitrary application of government regulations that increase the operating costs of the project. The potential for this effect varies by jurisdiction but IFIs can reduce these risks through a range of instruments, including ex ante technical assistance on the development of stable regulatory regimes before the infrastructure project is completed, and bonding measures, as in the case of extractives policy, to lengthen planning horizons, ex post.

Host governments can also mitigate infrastructure investment risks by pursuing macroeconomic stability, developing strong, transparent legal frameworks and by encouraging local currency savings. These considerations underscore the need for a broad perspective on the challenges associated with infrastructure investment.

*****

An effective strategy to stimulate infrastructure investment in emerging markets could help combat global deflationary pressures by recycling the surfeit of global savings into productive investments: governments with high debt-to-GDP ratios or weak institutional development, which cannot support high debt burdens, may want this investment financed by the private sector. In this respect, while the secular stagnation thesis remains subject to debate, a failure to restore global aggregate demand could heighten the risk that it moves from hypothesis to reality.