As predicted, there is considerable hand wringing about the effects of the Fed’s decision to undertake large scale asset purchases — aka: QE(n). See, for example, Martin Feldstein in the Financial Times.

I don’t mean to imply that there aren't risks associated with the Fed’s bold initiative; there are. For example, some have raised justifiable concerns about the effects of central banks buying up large quantities of highly liquid, benchmark issues. Because these assets are used as collateral to support the creation of other assets (i.e., loans), they worry that central bank operations intended to support economic growth and reduce the threat of deflation may in fact have the opposite effect; this risk underscores the significance of expanding the menu of assets under the program beyond U.S. Treasuries to asset-back securities (hat tip: JA). This “it’s the collateral, stupid!” perspective merits a future blog.

My point, rather, is that while there are risks of action, so too are there risks of inaction. And, on this score, an impartial reading of the IMF’s latest World Economic Outlook provides much food for thought. Apart from recent encouraging indicators in the U.S., the global outlook is looking decidedly bleak. This shouldn’t necessarily be a surprise given the continuing effects of the euro area troubles and the challenges faced by emerging markets with growth strategies based on debt-financed consumption in the advanced countries.

So, on the balance of risks, I think Chairman Bernanke is absolutely right.

I earlier argued that the QE(n) program would work by raising the cost of hoarding cash and getting firms to go out and do in practice what firms are supposed to do in theory — that is, invest.

Just how would that work? Part of the story here is expectations—I suspect that, while the Fed won’t come out and state it as such, to some extent they want to raise expectations of inflation. Of course, part of the story is the exchange rate: with other channels of the monetary transmission mechanism in the shop owing to financial market dysfunction and institutional deleveraging, the resulting exchange rate depreciation can help with the rebalancing of global demand.

But another element of the story is the effect on expectations of interest rates.

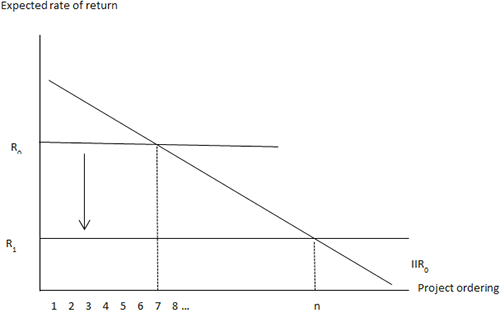

It shouldn’t come as a surprise that Keynes, who struggled with the same challenges of how to make monetary policy effective in a liquidity trap, also offers an interesting perspective on this issue. Imagine for the sake of simplicity that potential investment projects are all one period in duration (you invest at the start of the period; they produce a return at the end of the period). Moreover, these projects are ordered on a spectrum starting from those offering the highest expected return to projects offering progressively lower rates of return, as in figure 1 below. Assume for the moment that, in the short-run, the Fed’s action is unlikely to affect the expected returns of individual projects. The expected return schedule (the downward sloping line) doesn’t change. At the current low rates of inflation, which are assumed here, differences in real and nominal interest rates are taken to be minimal.[1]

What does change as a result of the Fed’s action is the rate at which projects are discounted or evaluated, which is reflected in the decline in the horizontal line from R0 to R1. At the initial discount rate of R0 the first 7 projects are assumed to be undertaken since they yield an internal rate of return greater than or equal to R0, but at the lower discount rate of R1 the first “n” projects on the spectrum of profitability are funded. Think of the intuition behind this as: you can get funding from the Fed at R, so you invest in a project as long as it generates a return of at least that.

Figure 1.

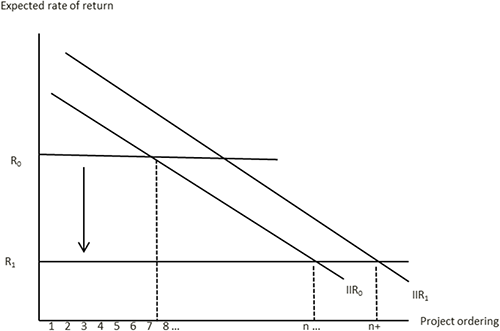

While ridiculously simple, I think this caricature of the real world helps us understand some rather important issues. To begin, think of the potential effects resulting from the fact that the increase in the number of projects undertaken translates into increased employment opportunities. With more people working, consumption will be higher. And under these conditions, the expected returns on the various projects may be higher. This effect is illustrated in Figure 2, where the expected returns schedule is shifted out to IRR1 and the number of projects funded is now n+. This second round effect is analogous to a Keynesian multiplier and it illustrates the positive-sum game nature of the economy.

Figure 2.

Of course, some readers might reasonably object, noting that not only do the Fed’s actions create an incentive for additional investment projects to be initiated, but they also create an environment of excessive risk-taking and the search for yield that characterized the run up to the global crisis. This is indeed a possibility; it underscores the need for heightened (and, hopefully, improved) prudential surveillance and regulatory oversight of those who might take non-mean-preserving bets which could leave taxpayers holding the bag if those bets don’t pan out.

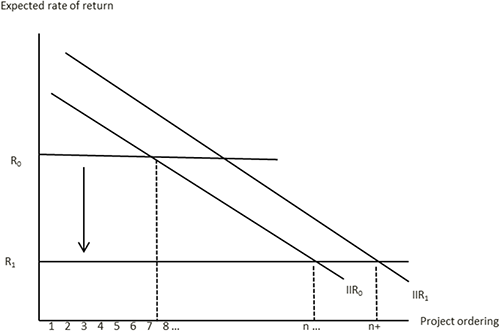

Other readers might ask: “what’s different?” They could, for example point out that even before its latest moves the Fed had reduced interest rates to remarkably low levels, with only a tepid recovery to show for its efforts. Such skepticism might be justified. But consider the environment of pervasive uncertainty which clouds planning horizons. In the context of our simple Keynesian analysis, firms don’t know with certainty what the expected return of their projects will be; they don’t know what the discount rate, R, will be over the life of their project (after all, in the real world, projects last for more than the single period considered here).

This situation is illustrated in Figure 3 below. The uncertainty with respect to expected rate of return on investment projects is illustrated by the schedules IIRL and IIRH, associated with low and high expectations of returns, respectively. Firms may be uncertain that interest rates will remain at the lower level of R1 and may be concerned that rates will return to R0 between the time it take to commit to the investment and the time at which the returns are reaped. In this case, the impact of lower interest rates may be much more muted than expected. Similarly, concerns that expected returns will turn out to be lower, ex post, could entail no increase in the number of projects undertaken, even if the Fed does lower the discount rate to R1.

Figure 3.

These effects underscore the problem of exercising the option value of waiting — particularly if there are fixed costs in starting investment projects, which would be borne even if the decision is made not to proceed with the project.

So, what does this have to do with the communications blitz associated with the Fed’s large scale asset purchases? The Fed’s goal is make a credible commitment to firms that when it says rates will remain low over the planning horizon, they mean it. In other words, they are putting money where their mouth (or at least their policy goals) is.

It is, perhaps, another example of how policy has to be rigorous, but not rigid in the New Age of Uncertainty.

[1] That being said, one possible explanation for the poor performance of investment in the current recovery is a possible money illusion effect identified by Modigliani and Cohen (1979), who argued that investors discount real returns from corporate cash flow by nominal interest rates. A similar effect might restrain investment if corporate managers discount the real returns from investment using discount rates that reflect higher expected inflation (owing perhaps to what they see as “imprudent” monetary policy actions, as some bombastic commentators have characterized Fed policy). See: Modigliani, Franco and Richard Cohn. (1979). Inflation, rational valuation, and the market. Financial Analysts Journal 35(3), 24-44.