Has it really been more than a month since my last post on Greece?

In that time, any goodwill coming out of the end-February agreement to extend the Greek debt agreement has melted away like snow in spring sunshine. A month later, the Greek government once again faces a looming financial constraint and the relationship between Athens and Berlin seemingly grows more strained by the day. In this environment, there are fears that Greece will choose to, or be forced to, exit the Eurozone. That outcome would be a leap into the unknown.

It seems that the two key protagonists in this drama, the Greek and German finance ministers, simply can’t agree. Or, as the title has it: Why Kant Schäuble and Varoufakis Agree?

A previous post, here, noted that Greek finance minister Yanis Varoufakis invoked the influential German philosopher Immanuel Kant to explain Greece’s negotiating position with the EU:

“The major influence here is Immanuel Kant, the German philosopher who taught us that the rational and the free escape the empire of expediency by doing what is right.”

Yet, German Finance Minister Schäuble could equally cite Kant’s credo. After all, Minister Schäuble undoubtedly believes that, in protecting the interests of all those frugal Germans whose savings were invested in Greece from the spendthrifts of Athens he too is "doing right."

If that is his motivation, some might argue, he should have protected German taxpayers from the banks that lent the money in the first place. Go back a decade. At the time, Germany was running large current account surpluses. Now, the counterpart to those surpluses was large deficits in the capital account: Germany was "exporting" fewer financial assets than the claims on others it was "importing" — those bank loans and bond purchases made to Greece. However, German banks were also investing heavily in U.S. sub-prime mortgage securities. Why was there no German bailout of the U.S. government, with or without the IMF? How is it that U.S. growth rebounded — albeit at a pretty tepid pace — following the global crisis and unemployment is now approaching pre-crisis levels while Greece remains trapped in a 1930s depression?

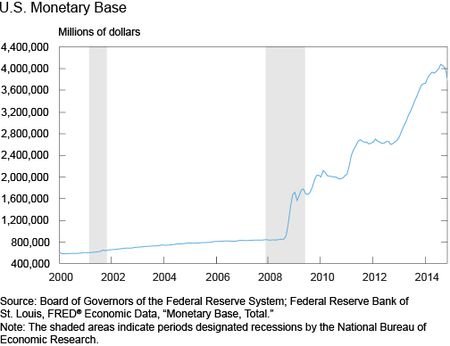

The big difference is that the U.S. has independent monetary policy; Greece does not. In the wake of the crisis, the U.S. Federal Reserve Board acted aggressively, and appropriately, to offset the cataclysmic effects of the collapse of credit. In doing so, it insulated the U.S. economy from the kind of economic dislocation that has befallen Greece, Spain, and Portugal, which have all struggled with Great Depression levels of unemployment. The chart below, taken from Marco Del Negro and Christopher A. Sims: Central Bank Solvency and Inflation, shows the evolution of U.S. based money over the past six years. The response by the Fed to the deterioration of the economy in late 2008 is clearly visible, as is the subsequent use of quantitative easing to “grow” the balance sheet. Whether you agree with this response or not, it can’t be said that Fed Ben Bernanke failed to act (unlike his predecessor in the 1930s, when in response to the banking crisis of the Great Depression the Fed didn’t respond accordingly).

At the end of the day, there was no bailout for the U.S. with conditions attached — and no heated negotiations between Brussels and Washington — because German banks held dollar-denominated assets and the U.S. retained its monetary independence.

Greece didn't. And, in the wake of a colossal credit shock, the ECB under then-President Jean-Claude Trichet, actually (inconceivably?) tightened monetary conditions after an initial increase in base money before Mario Draghi took the reins of the ECB and committed to “do whatever it takes” to save the euro, pursuing a more consistent policy to support growth. Sound confusing? It should. While not the only factor, that go-stop-go response helps explain the dismissal performance of the Eurozone over the past six years; compared to the clear communication and determined efforts of the Fed, ECB policy making circa 2008-2011 seems to have been intentionally engineered to confuse. In times of crisis, in which there is a risk of the economy slipping into “bad” equilibrium, adding to uncertainty generally isn't a good idea. Monetary policy has potency if it is effective in coordinating the actions of individuals around a “good” equilibrium.

Needless to say, Eurozone monetary policy isn't the only point of contention and sole source of conflict between Athens and Berlin. There is, obviously, the issue of the debt burden and the reluctance of the Greeks to adhere to economic programs that are not working as intended in order to save German banks. However, the lack of an independent monetary policy greatly restricts Greece’s ability to grow its way out of its present malaise. Moreover, the fact that Athens probably sees Germany using its influence over the ECB to apply pressure on Greece in the debt negotiations doesn't help.

This is not to say exit from the Eurozone would be without cost for Greece. It would not — think of the problem of confronting Greek banks with euro-denominated deposits. Although the re-introduction of the drachma (at a depreciated rate) would allow for external adjustment and current account surpluses, that flow of euro earnings coming into the economy would be small relative to stock of euro liabilities. Absent some measure, such as the conversion of deposits into equity (possibly preferred equity earning a return) through force majure, banks would likely fail.

But “Grexit” would also be painful for Germany and the rest of the Eurozone. In the first instance, the value of their claims on Greece would fall: does anyone think that the net present value of Greek debt would be higher post-Grexit? At the same time, there may be much larger effects that would harm the members of the Eurozone and do lasting damage to the global economy. Greece is a small, some might say inconsequential, part of the Eurozone; some might exclaim the braggadocio: “let them go.” Be careful of what you suggest. Recall that even the sagacious Ben Bernanke initially believed that the subprime market was too small to do lasting, systemic damage. What he didn't count on was cascading liquidity crises spreading from one credit market to the next until the very foundations of the U.S. (and global) financial system threatened to collapse.

The exit of any member of the currency union would demonstrate that, regardless of high-sounding pronouncements made regarding the permanence of the union, it is a voluntary arrangement between sovereign states. If one member exits, others might follow. The scenario feared by the ECB is an unwinding of the union, as fewer and fewer members remain to support the currency. In such circumstances, the very existence of the Euro as a fiat currency would be questioned. And, if the very nature of the currency is questioned, so too its role as a store of value. This could have very large costs to the E.U. as a whole (and, indeed, the global economy should there be a “hot potato” problem in holding Euro-denominated assets with possible financial disorder).

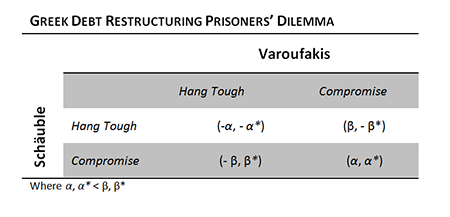

The situation may be analogous to the ubiquitous prisoners’ dilemma of game theory in which both sides stand to benefit from cooperation but each fears the outcome if the other reneges on the cooperative agreement. Consider the Varoufakis-Schäuble bargaining problem below. Payoffs associated with different outcomes are provided in the cells corresponding to the play of the two protagonists (where α, β and α*, β* represent the payoffs to Schäuble and Varoufakis, respectively).

With the assumed values, each player has a clear incentive to cooperate — to “compromise.” Yet each player has an incentive to “hang tough” if the other compromises, since this yields β, β* respectively which is greater than α, α*. To see this, consider what happens if either player commits to compromise — German agreement, say, to provide continued financing for Greece, or Greek agreement to undertake some domestic adjustment. If one player were to follow that strategy, however, the other player would then have an incentive to renege: Germany seeking to get Greek adjustment without additional lending; Greece hoping for additional lending without painful domestic adjustment. Absent some means to bind the other to the cooperative outcome, both sides will chose to “hang tough” which is a strictly inferior outcome to cooperation.

This is obviously a highly-stylized (some might say superficial) illustration of the difficult negotiations involved in the current impasse. That it is. But the simple prisoners’ dilemma game does illustrate a key result: that while cooperative outcomes (the “compromise-compromise” cell) dominate non-cooperative outcomes, they require some form of commitment device or institution to monitor the agreement. That is what the IMF was designed to do, in the first instance, with respect to beggar-thy-neighbour exchange rate devaluations in the post-war period—although, as I have argued, here, the underlying objective of the Bretton Woods system was to facilitate timely, orderly adjustment in the global economy consistent with full employment and progressive trade liberalization.

The Bretton Woods system succeeded after a fashion because it allowed countries to mobilize a menu of instruments, including independent monetary policy, to make the adjustments that were required of them. (Those that did not, and which relied too heavily on financing were subject to periodic balance of payments crises.) The system was criticized, however, as forcing the full burden of adjustment on deficit countries rather than sharing the load between surplus and deficit countries. In the negotiations leading to Bretton Woods over 70 years ago, Keynes tried to insert some degree of symmetry into the system through his "clearing union" proposal. He failed.

Fast forward seven decades. Today, the dispute between Germany and Greece threatens to become intractable because Greece lacks the capacity to undertake independent monetary policy, while the onus of adjustment within the Eurozone is solely on deficit countries. The Greek government, pointing to the unacceptably high level of unemployment and failed growth projections, claims that past policies of adjustment are discredited and should be abandoned. The German government, defending the principle of payments discipline and protecting the interests of German savers, is equally adamant about the need for some adjustment. Both may see themselves as escaping the empire of expediency by doing what is right.

So, why can’t Schäuble and Varoufakis agree? Kant.