Spain and Italy are both expected to emerge from a recession this year with projected growth of 0.6 percent. However, even though the static snapshots of growth appear the same, Spain and Italy face very different macroeconomic and financial conditions and risks over the medium term.

Italy’s debt-to-GDP ratio is the second largest in the euro zone next to Greece, at approximately 133 percent. It is expected to peak in 2014 at 134 percent and fall over the medium term, primarily owing to aggressive fiscal consolidation. Spain’s debt is significantly smaller at approximately 94 percent of GDP, but slower progress toward fiscal consolidation suggests that the Spanish debt level will continue to rise over the medium term, peaking at 105 percent of GDP in 2017. These dynamics are not without their risks: when the debt-to-GDP ratio is high, it becomes particularly vulnerable to fluctuations in growth and inflation rates, and the interest rate paid on government debt.

Annual year-end inflation was 0.8 percent in 2013: its lowest rate since the euro zone was established and well below forecasters’ expectations. In its most recent World Economic Outlook (WEO) update, the International Monetary Fund (IMF) warned that there is a heightened risk of deflation in the euro zone that needs to be addressed. Christine Lagarde, the managing director of the IMF, clarified these risks at the World Economic Forum (WEF) in Davos, Switzerland, asserting that the risks of deflation are low, around 15 to 20 percent, but that they would materialize in the event of a shock to economies that already have low inflation (WEF 2014). Officials at the European Central Bank (ECB) have been adamant that, while it is likely that inflation pressures will remain low for a long time, they are confident that inflation remains well anchored around the two percent target over the medium to long term. They further reassure that if deflationary pressures were to develop, they are prepared to act accordingly by decreasing the main refinancing interest rate, setting a negative deposit rate, strengthening forward guidance or even introducing a large-scale asset purchase program. The ECB has been able to manage expectation well in the past, but the recently introduced Outright Monetary Transaction program is being challenged before the German Constitutional Court. Without confidence that the ECB will be able to act decisively and aggressively in preventing deflation, there is a risk that inflation expectations could become unanchored over the medium term.

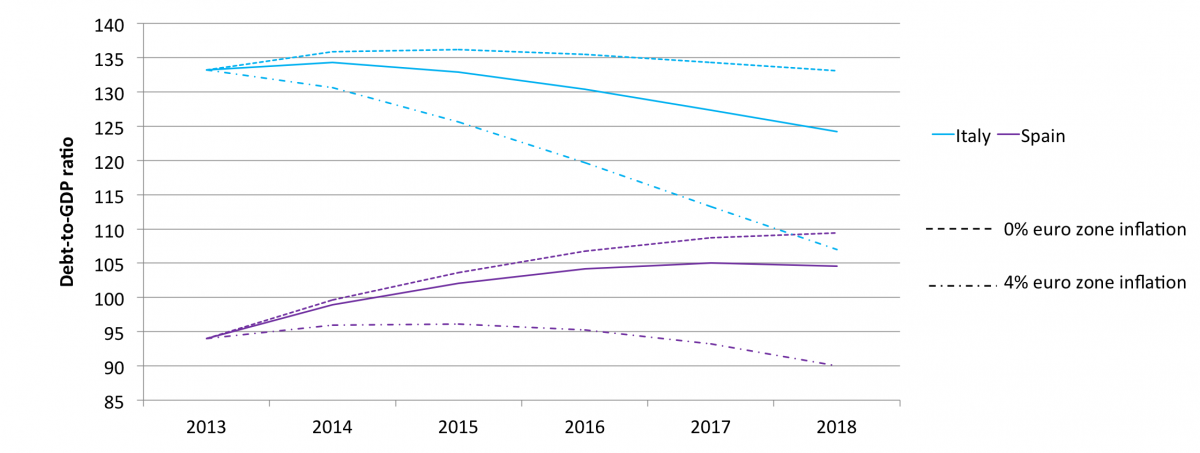

Figure 1 illustrates the vulnerability of Italian and Spanish debt dynamics to fluctuations in the inflation rate. Under the IMF’s most recent projections, the debt-to-GDP ratio is expected to fall to 124 percent in Italy and 105 percent in Spain by 2018. If euro-zone inflation were to slow to zero percent and remain at that level over the medium term, then the debt-to-GDP ratio in Italy would rest at its current level of 133 percent in 2018. In Spain, low inflation would cause debt to rise indefinitely over the medium term, reaching 109 percent of GDP by 2018. Alternatively, if inflation in the euro zone were to increase beyond the ECB’s target to four percent, debt-to-GDP ratios in Italy and Spain would fall to 107 and 90 percent by 2018, respectively. Even if fluctuations in growth or inflation are relatively small, they can have a significant impact on debt dynamics: for every percentage point that the inflation or growth rates fall below the IMF’s latest projections, the debt ratio rises by 1 percentage point in Spain and by 1.3 percentage points in Italy.

Figure 1: Debt Dynamics in Spain and Italy under Different Inflation Scenarios

Notes: Inflation scenarios in Italy and Spain are estimated based on the average standard deviation inflation has diverged from the euro-zone mean in the past two years. Inflation in Italy and Spain have, on average, been higher than the euro-zone mean over the past two years; therefore, the inflation rates in these scenarios are also slightly above the euro-zone rate. Source: Authors’ elaboration on IMF (2013; 2014) and ECB (2014).

Debt dynamics are also vulnerable to fluctuations in interest rates paid on government debt. Spanish and Italian bond ratings rest one and two notches above junk grade, respectively — but the risks associated with these ratings differ. The export-driven recovery in Spain coupled with credible commitments to fiscal sustainability led Moody’s, Standard & Poor’s and Fitch to revise their outlooks from negative to stable in the fall of last year. In Italy, on the other hand, the “Big Three” credit rating agencies kept their outlooks at negative due to the uncertainty over structural reforms and the vulnerability of high public debt in an environment of weak growth and inflation. Further downgrade(s) of Italy’s sovereign ratings could compromise its ability to access markets at a sustainable cost.

Instability in the domestic banking system has the potential to heighten sovereign debt concerns because of the large fiscal costs associated with rescuing banks. Using financial assistance from a European Stability Mechanism program, Spain has already recapitalized and restructured its banking system. Furthermore, detailed analysis of the liquidity positions and exposures of Spanish banks have increased transparency. The risk of a negative sovereign-bank feedback loop in Spain is, therefore, relatively low. In Italy, on the other hand, the capital position and stock of non-performing loans on banks’ balance sheets may reveal surprises. In addition, domestic sovereign debt represents 10.5 percent of the assets on Italian monetary and financial institutions’ balance sheets. Unexpected results from the ECB’s asset quality review and stress tests could escalate pressure on the banking system, causing risk premiums on Italian bonds to increase and, therefore, unhinge the sustainable debt dynamics forecasted over the medium term. As suggested by the IMF (2014), it is important that the banking union include both a single supervision and crisis resolution mechanism to break the sovereign-bank feedback loop.

In summary, debt dynamics are projected to be relatively stable in Spain and Italy over the medium term. When levels of government debt are high, however, debt dynamics are very sensitive to growth, inflation and interest rates. Italy will be particularly vulnerable to these fluctuations because it has a larger stock of debt and a more fragile banking system. Euro-zone policy makers need to restore confidence by improving cooperation and granting the relevant bodies the authority to act decisively and effectively in the event of a shock.

Works Cited

ECB. 2014. Statistical Data Warehouse. Frankfurt: ECB.

IMF. 2013. World Economic Outlook Database. October. Washington, DC: IMF.

———. 2014. World Economic Outlook (WEO) Update: Is the Tide Rising? January. Washington, DC: IMF.

WEF. 2014. “Global Economic Outlook 2014.” Session at the WEF Annual Meeting, January 25, Davos. www.weforum.org/sessions/summary/global-economic-outlook-2014.