We Thought We Were All in This Together

Much has changed since the crisis-driven G20 summits in London and Pittsburgh in 2009. The London summit promised action to strengthen regulation and supervision of financial institutions as well as improved cooperation, notably in launching an early warning “exercise” and work on “exit strategies.”[1] The Pittsburgh summit promised an end to an “era of irresponsibility” and noted that the leaders’ prompt and aggressive policy response “worked” by planting the seeds of a return to stability following a global economic contraction. Echoing the sentiments of the London summit, the leaders also committed their governments to “avoid any premature withdrawal of stimulus. At the same time, we will prepare our exit strategies and, when the time is right, withdraw our extraordinary policy support in a cooperative and coordinated way, maintaining our commitment to fiscal responsibility.”[2] The early warning exercise has not shown much promise so far, in part because there is little evidence of commitment to the idea together with academic research that demonstrates the futility of the exercise (for example, see Rose and Spiegel, 2009). Meanwhile, there is growing evidence that premature stimulus withdrawal is precisely what several politicians have undertaken, largely prompted by political imperatives as opposed to relying on purely economic arguments. The tide may have slowed, but it is far from clear that it is reversing in spite of the misunderstanding of the economic principles involved.[3]

Since those heady days, the united stance of the G20 seems to have dissipated. The ministerial meetings in Washington, DC, in April of this year, revealed growing rifts in policy directions. Displays of enhanced cooperation, much less coordination, seem to be taking a back seat to an individualistic desire among individual members of the G20 to find the combination of policies that will enable their economies to reach “escape velocity,” the principle borrowed from physics and used by Mark Carney, former Governor of the Bank of Canada and now Governor of the Bank of England, to describe the failure of the US economy to return to normal.[4] Indeed, the feeling that the major economies of the world are mired in slow growth and incapable of developing a balanced or coherent view about the appropriate stance of fiscal policy, further contributes to the impression that the G20 is unable to live up to its early promise to create a forum for economic cooperation and coordination of the Bretton Woods variety, “to achieve stable and sustainable world growth that benefits all” (Kirton, 1999). Instead, the G20 is described by some as a group where “[C]ountries fight to be admitted to the club, but do little with membership” (Harding and Giles, 2013).

Disagreement inside the G20 likely reflects the unhappiness with the aftermath of what was, at first, a global push to stimulate economies lest the world repeat the universally feared Great Depression of the 1930s. Nevertheless, it is striking, five years after the London and Pittsburgh summits, how quickly the G20 has given the appearance of not being able to convincingly sing from the same song sheet.

The Current State of Macroeconomic Play

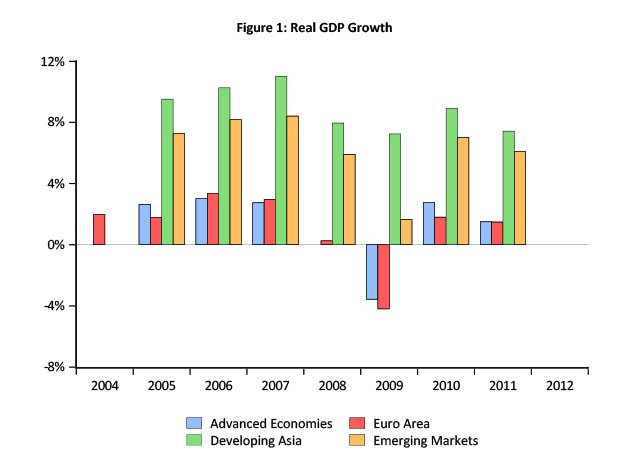

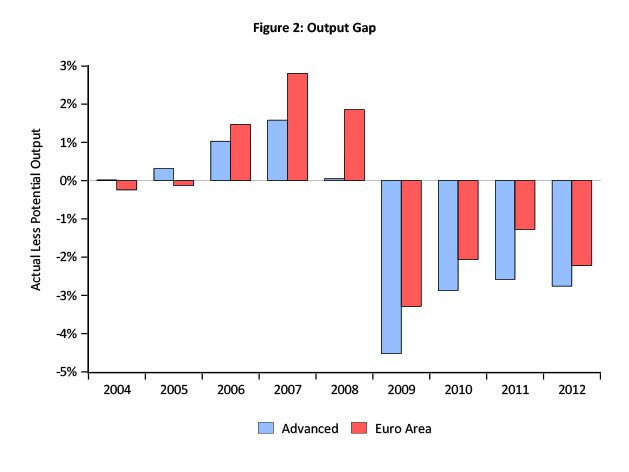

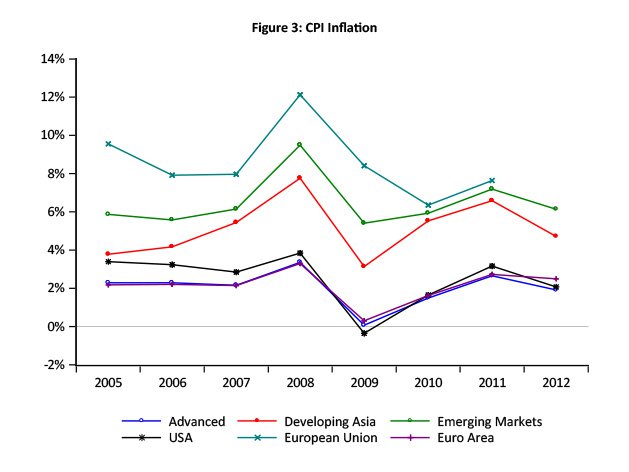

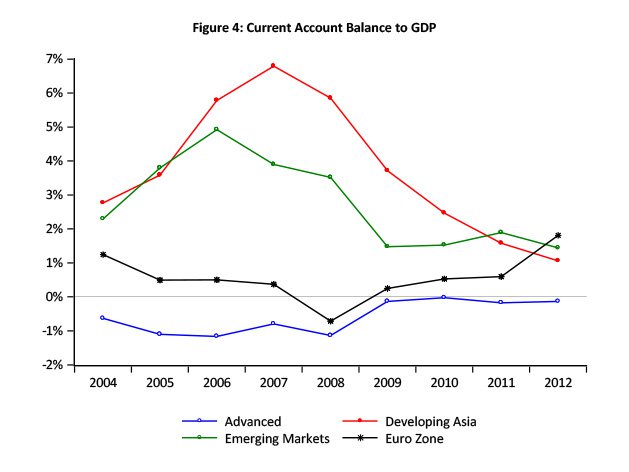

As shown in the four Key Macroeconomic Indicator figures below, economies in different parts of the world diverge along key macroeconomic dimensions. These divergences reflect the change in tone in international policy discussions and give rise to what may be termed the “Great Fragmentation.” This is meant to convey the idea that the G20 appears to be an orchestra without real leadership or a common purpose. As we shall see, however, not all the news is bad.

Figure 1 shows real GDP growth in four regions of the world. Sluggish growth in the advanced and euro-area economies (also one of the advanced economies) relative to Asia and emerging market economies is evident. Nevertheless, it is also remarkable that, except for 2009, real economic growth has not been negative in any region of the world. When this is contrasted with the almost 30 percent decline in the United States’ real GDP alone during the period 1929 to 1933,[5] in the aftermath of possibly the largest global financial shock in economic history, the international response to the crisis — in no small part spurred by G20 action — is remarkable. Why G20 member governments have not made more of this is entirely unclear.

Behind these figures, however, are other macroeconomic data that are much less favourable. Figure 2 shows that, in the advanced and euro-zone economies, the gap between actual and potential output — that is, the so-called output gap — continues to be stubbornly negative. Indeed, the cumulative output gap since 2009 in each of these two regions exceeds 10 percent of GDP, and is likely to rise as both the advanced and euro-zone economies are likely to experience a fifth consecutive year of negative output gaps.[6] Data such as these give some additional support to the notion that the world is undergoing a “three-speed” recovery (Blanchard, 2013). No doubt it is these kinds of developments that prompted the Russian presidency of the G20 to focus on economic growth through various avenues as among its priorities for the St. Petersburg summit.

Figure 3 plots inflation performance in the same four regions. Here, too, there is a marked difference between inflation in the advanced and euro-zone economies relative to ones that are experiencing considerably stronger growth. The good news is that, contrary to fears expressed by some that the United States, in particular, is seeking to “export” inflation abroad via an unprecedented loose monetary policy, there is little evidence of this happening so far. Not shown, however, are figures that reveal that, while the advanced world is deleveraging, several economies — most notably in Asia — are experiencing surges in debt-to-GDP levels (for example, see Frangos, 2013). Only time will tell whether there will be a resurgence of inflation. Yet, it is clear that inflation worries are top of mind among policy makers in Asia (for example, see Siklos, 2013).[7]

Finally, Figure 4 reveals that the financial crisis, and its aftermath, has led to a considerable narrowing of current account balances, again in relation to GDP levels. The so-called imbalances, when the global financial crisis erupted, which policy makers complained were one source of the build-up of disequilibria in the world economy, have largely disappeared from view. To some extent, this outcome has been facilitated by China’s loss of competitiveness while competitiveness gains in the United States and Germany have also accelerated the convergence of current accounts to something resembling balance.[8] Of course, imbalances must be understood relative to the context in which they are evaluated. For example, if one examines imbalances within the euro zone, these persist and remain a source of tension not only inside the euro zone, and the European Union more generally, but the spillovers onto the world stage suggest that an important systemic source of risk for the world economy is far from being removed. Indeed, 14 of 27 EU member states are now being subjected to further study based on the European Commission’s (EC) most recent alert mechanism report (EC, 2012).

The bottom line is that the current malaise about policy makers' inability to present a united front is primarily a story of diverging economic growth in different regions of the world. The actual situation, at least on the macroeconomic front, is not as dire as it appears at first glance. Yet, one cannot help but recall the words of former Fed Chairman, Arthur Burns, at another perilous juncture in economic history, namely on the eve of the first of two oil price shocks of the 1970s that would produce stagflation for almost a decade: “if cooperative efforts…are long postponed...[w]e might then find the world divided into restrictive and inward-looking blocks…a world of financial manipulation, economic restrictions, and political frictions” (Burns, 1972).

As will be argued below, the current state of play also reflects fragmentation in other areas, notably in misunderstandings about the potential for each economy to put its house in order to positively contribute to improve global economic performance, fears over the spillover effects from loose monetary policies and continued substantial differences of opinion about the road ahead for financial reforms.

Plus ça Change?

The challenges and risks in implementing policies that will ensure healthy economic growth remain significant, as the International Monetary Fund (IMF) has acknowledged (IMF, 2013). In this environment, there is seemingly more that divides the G20 than unites it in putting international cooperation back on track. However, before one reaches the conclusion that only dire outcomes are possible in the foreseeable future, it is once again worth looking back to 1971 when Bretton Woods was abandoned and policy makers were grappling with what kind of monetary system would replace it. In the same speech by Arthur Burns cited above, he argues that “[A] major weakness of the old system was its failure to treat in a symmetrical manner the responsibilities of surplus and deficit countries. With deficits equated to sin and surpluses to virtue, moral as well as financial pressures were very much greater on deficit countries to reduce their deficits that on surplus countries to reduce surpluses.”

Those words were uttered over 40 years ago. Yet, a look at the euro zone today suggests that the weaknesses that were present then are still with us today. Unlike 40 years ago, however, it is no longer possible to envisage the G3 (United States, Japan and Germany) arriving at an understanding about exchange rates (that is, the Smithsonian Agreement of 1971), even if one believes (and many do not) that the resulting realignment of exchange rates succeeded in halting a “dangerous trend toward competitive and even antagonistic national economic policies” (Burns, 1971). When it comes to international trade, the current environment has led to a curious state of affairs whereby the threat of a currency war seems ever present, whereas within the euro zone, the war is one of attrition with member-state governments seeking to see how far they can go with internal devaluations and fiscal austerity before the alternative of an exit of the euro zone is taken. Indeed, the thought of a currency war initiated by the euro zone as a whole appears inconceivable. After all, individual euro-zone members no longer have the tools to independently depreciate the currency. Such a decision can only be made collectively, and it is unclear how each member of the monetary union can benefit from such action. Meanwhile, financial globalization has ensured that even if gains in competitiveness are sought via more favourable exchange rates, these can be undone by the reaction of financial markets and their ability to move vast amounts of funds with little delay.

It is equally curious that those who warn about the dire consequences of worsening currency wars (for example, Bergsten, 2013) choose to focus mainly on China, exaggerate the degree to which currencies are being manipulated and fail to acknowledge that exchange rate depreciation simply no longer delivers the same benefits that it used to nor can it be expected to help return advanced economies to pre-crisis growth levels. As noted above, China’s exchange rate has appreciated considerably. Also, while it is true that some central banks — for example, Switzerland and New Zealand — have shown more enthusiasm about intervening in foreign exchange markets, the amount of forex intervention pales in comparison with what used to be the norm decades ago. Finally, there is considerable evidence (for example, Bailliu, Dong and Murray, 2010) that exchange rate pass-through effects have diminished substantially in recent years, largely because low and stable inflation has become an accepted strategy for delivering good monetary policy.

Of course, to the extent that destructive currency manipulation poses real economic effects, one course of action would be to sanction or fine countries that resort to “beggar-thy-neighbour” policies. Even if this is desirable, there are simply no successful historical examples of a “system” of sanctions of this kind to rely on as a model. If the Europeans can wiggle their way out of comparatively mild restrictions on excessive budget deficits[9] that are, in principle, subject to sanctions, it is very doubtful that the international community can agree on dealing with currency manipulators. The bottom line, at least superficially, is that the current international monetary system does not seem to have improved much over the last several decades.

More Unites Us than Divides the United States: Securing Existing Gains and the Way Forward

All is not as bleak as it might appear. Gone are the days when a few large economic powers made decisions with global repercussions without much dialogue with those who were affected by their decisions. In spite of its flaws, the G20 does represent a start at developing a mechanism to deliver good global governance. Paralleling this development is the recognition that low and stable inflation is the essential ingredient of good monetary policy.

There remain, however, two large gaps of a “technical” nature and one of a “cultural” nature that must be filled in order to lay the groundwork for renewed economic growth. The “cultural” gap is likely the most intractable. While some (for example, Shambaugh, 2013: chapter 4) have noted that China is uncomfortable with the notion of “global governance,” the same can surely be said of the United States. Whether it is in the area of banking and financial reform or in the appropriate fiscal stance, the US Congress has routinely shown hostility toward global governance principles. Nowhere is this more abundantly clear than when US monetary policy is carried out without much care given to potential global spillover effects, in spite of a growing body of research that suggests that spillovers are significant (for example, Bauer and Neely, 2012). In part, the justification is that the resulting spillovers are thought to be positive, or at least not negative (Bernanke, 2012), while agreements such as the G20’s Mutual Assessment Program commit its members “to monitor and minimize the negative spillovers of policies implemented for domestic purposes” (IMF, 2013a).

Since it is impractical to think that all members share equally from the “public good” that is global governance, the G20 might devote more effort to persuading its largest and most influential members that there is more to gain from an international policy regime than the costs borne in monitoring and enforcing it. The G20 might want to heed Woodrow Wilson’s advice of long ago, in the dying days of World War I, about how to ensure the peace: “There must be, not a balance of power, but a community of power” (Wilson, 1917).

A secondary issue is whether the size and diversity of the G20 gives rise to problems endemic in large groups of the kind Mancur Olson (1965) discusses in his seminal contribution on the challenges of collective action. Rather than being viewed as an organization where all of its members are treated equally, at least in principle, it ought to act more like a federation where certain blocks, more affected by some policy questions than others, can opt out so long as some minimum established standards are maintained. To assist in creating more confidence in the G20 process, escape clauses could be added that are transparent and set the limits to international cooperation (for example, see Siklos, 2013).

A case in point is the implementation of Basel III reforms (for example, see Bank for International Settlements, 2013). In a sample of banks examined by the Basel Committee, several G20 members have no internationally active banks (Argentina, Indonesia and Mexico). Similarly, the sample includes several other member countries where banks are smaller and are not internationally active (Brazil, China, Saudi Arabia and the United States).[10] To suggest that a “one-size-fits-all” regime will work is neither helpful nor realistic.

Turning to the “technical” gaps that need to be filled, two are most glaring. They are: greater acceptance that international standards for financial supervision and regulation are essential; and an attempt to devise rules for good conduct in fiscal policy. Failure to deal with the first question will once again permit financial institutions to exploit new gaps or, worse still, undo the very benefits of financial globalization — namely, the flow of credit to where it is most valuable will be lost. Forces leading in this direction are already underway (The Economist, 2013). This is not to say that a single regime will fit all G20 member states. Nevertheless, since financial structure and the degree of maturity across countries does vary considerably, there ought to be room for idiosyncratic systems, while also seeking to minimize regulatory arbitrage that contributed to the build-up of financial imbalances in the years that preceded the global financial crisis. In the case of fiscal policy, just as central bankers learned the hard way that only a judicious mix of rules and discretion can lead to low and stable inflation, a similar effort needs to be undertaken to find that mix. To be sure, several such arrangements have been proposed and implemented to a greater or lesser extent, but there is, as yet, no common ground on the subject, possibly because existing rules are seen as being too complex (for example, see Schaechter et al., 2012).

While the above represent a list of what the G20 can do, there is also one suggestion for what the G20 should cease doing — namely, relying too heavily on central banks to deal with the challenges they face. Not only does doing so violate any reasonable principle of good global governance by increasingly removing the adoption of policies and decision making to unelected officials, but the recent course of events makes it plainly clear that monetary policy has its limits. Unfortunately, this principle, like some of the others mentioned above, has also been violated time and time again. Paul Volcker, in the early 1980s, warned as much when he stated, “[I]ndustrial nations…nowadays rely heavily — sometimes too heavily — on their central banks and on monetary policy to achieve our economic goals; to promote growth and employment, to blunt the forces of inflation, and to maintain financial stability” (Volker, 1984). Add another lesson that has yet to be fully learned.

Key Macroeconomic Indicators

Sources: IMF International Financial Statistics CD-ROM (February 2013) and World Economic Outlook data set (April 2013). For a list of countries in the various regional groupings shown above see: www.imf.org/external/pubs/ft/weo/2013/01/weodata/weoselagr.aspx#a110.

Works Cited:

Bailliu, J., W. Dong and J. Murray (2010). “Has Exchange Rate Pass-Through Really Declined? Recent Insights from the Literature,” Bank of Canada Review (Autumn): 1–8.

Bank for International Settlements (2013). “Report to G20 Financial Ministers and Central Bank Governors on Monitoring Implementation of Basel III Regulatory Reform.” April.

Bauer, M. and C. Neely (2012). “International Channels of the Fed’s Unconventional Monetary Policy,” Federal Reserve Bank of St. Louis working paper 2012-028B.

Bergsten, C. Fred (2013). “Currency Wars, The Economy of the United States and Reform of the International Monetary System,” Stavros Niarchos Foundation Lecture, May 16.

Bernanke, Ben (2012). “Opening Remarks,” in The Changing Landscape, 2012 Economic Policy Symposium, August.

Blanchard, O. (2013). “The World’s Three-Speed Economic Recovery,” iMFdirect (blog), April 16.

Burns, A. (1972), “Some Essentials of International Monetary Reform.” Speech given before the 1972 International Banking Conference, Montreal, May 12. Available at: http://fraser.stlouisfed.org/docs/historical/burns/Burns_19720512.pdf.

EC (2012). “Report From the Commission to the European Parliament, The Council, The European Central Bank, The European Economic and Social Committee, The Committee of the Regions and the European Investment Bank,” on the Alert Mechanism Report, Brussels, November 28.

Frangos, A. (2013). “Asia Goes on Debt Binge as Much of World Sobers Up,” Wall Street Journal, May 24.

Harding, R. and C. Giles (2013). “Policy Makers Avoid United Stance Despite Instability Fears,” Financial Times, April 20-21.

IMF (2013). “Global Prospects and Policy Challenges,” meetings of the G20 Finance Ministers and Central Bank Governors. April 18-19.

IMF (2013a). “The G20 Mutual Assessment Process (MAP),” Factsheet.

Kirton, John (1999). The G7 and the Management of the International Financial System.G8 Information Centre, University of Toronto. Available at: www.g8.utoronto.ca/scholar/kirton199903/.

Olson, Mancour (1965). The Logic of Collective Action. Cambridge: Cambridge University Press.

Rose, A. and M. Spiegel (2009). “Predicting Crises, Part II: Did Anything Matter (or Everybody)?” FRBSF Economic Letter, September 28.

Schaechter, A., T. Kinda, N. Budina and A. Weber (2012). “Fiscal Rules in Response to the Crisis – Toward the ‘Next Generation’ Rules. A New Dataset,” IMF working paper 12/187, July.

Shambaugh, D. (2013). China Goes Global: The Partial Power. Oxford: Oxford University Press.

Siklos, Pierre L. (2013). “Another Fine Mess: Repairing the Governance of International Financial Regulation,” in Five Years After the Fall: The Governance Legacies of the Global Financial Crisis. The Centre for International Governance Innovation. Available at: www.cigionline.org/publications/2013/3/five-years-after-the-fall.

The Economist (2013). “Regulation: The Bite is Worse than the Bark.” May 11.

Volcker, Paul (1984). “Remarks,” by Paul A. Volcker, at the 78th Commencement of the American University, January 29.

Wilson, W. (1917). “We Need Peace Without Victory.” Speech to the American Senate, January 22.

[3] This, of course, refers to the publicity surrounding the validity of academic research linking debt levels to economic performance.

[5] Based on figures obtained from Global Financial Data.

[6] Because the gap can be larger or smaller depending on whether potential output falls or not during a recession, as is often the case, the poor economic performance in the advanced and euro zone economies may conceivably be worse that actually shown.

[7] For additional information see: http://online.wsj.com/article/SB10001424127887323789704578447080476172420.html.

[8] Real exchange rate movements (not shown) confirm the strong appreciation of the Chinese renminbi, while euro and the US dollar real exchange rates have depreciated substantially.

[9] At least members of the European Union have agreed on a definition of what “excessive” means, even if members resort to accounting and other devices to escape the fiscal restrictions they have agreed to. There is even less agreement on what “excessive” means when it comes to exchange rate movements.

[10] The banks referred to are the so-called Group 1 banks (capital in excess of €3 billion and internationally active. All other banks are considered Group 2 banks.