Substantial differences in math and reading skills by parental income are already evident by the time children enter school, and persist throughout childhood into adolescence (Carneiro and Heckman 2002; Cunha et al. 2006). Studies also show that income-based differences in adolescent achievement go a long way toward explaining later differences in educational attainment and lifetime earnings (Keane and Wolpin 1997; Carneiro and Heckman 2002). Together, these findings suggest that a generation’s fate may be largely sealed by the time they enter school. If this is true, an understanding of intergenerational mobility and its implications for economic and social policy requires an answer to the vexing question: why do poor children perform so poorly?

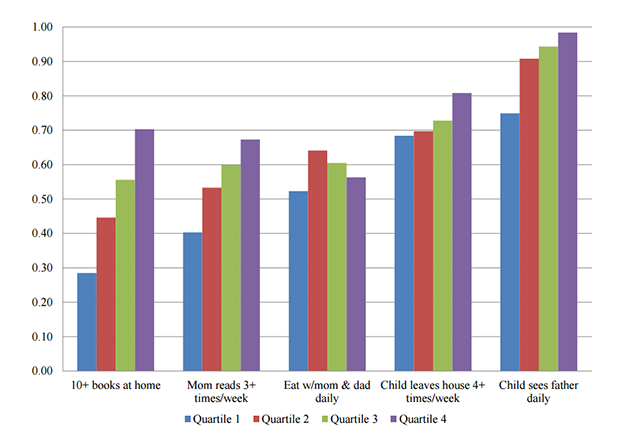

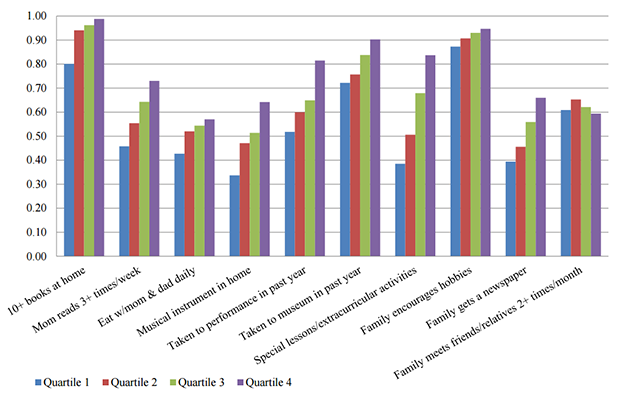

Income-based achievement gaps are accompanied and, at least partially, caused by substantial differences in the extent to which rich and poor parents invest in their children, as shown in Figures 1 and 2. For example, mothers of very young children from the highest income quartile are more than twice as likely to have 10 or more books in the home, and over 50 percent are more likely to read to their child three or more times per week, compared to mothers from the lowest income quartile. Children from six to seven years old from high-income families are more than twice as likely to be enrolled in special lessons or extracurricular activities, compared to their lower-income counterparts.

Figure 1: Family Investments in Children Ages 0–1 by Parental Income Quartile

Source: Caucutt, Lochner and Park (2015).

Figure 2: Family Investments in Children Ages 6–7 by Parental Income Quartile

Source: Caucutt, Lochner and Park (2015).

Why do rich and poor parents invest so differently in their children?

One significant reason that rich parents invest so much time and money in their children’s development is to improve their career prospects when they grow up. Economic theory tells us that if this were the only reason families invested in their children (and all parents had sufficient access to credit), then families should all invest time and money in their children, until the labour market return to their last dollar invested in a child equals the return that could be earned by investing that dollar at the bank. This does not necessarily mean that all families should invest the same amount in their children. Indeed, more able children, who earn a higher return for the amount of time and money invested in them, should receive a greater investment and exhibit higher achievement before the returns on their investments are driven down to the return on savings.

This suggests one reason why children from higher income families receive greater investment and perform better academically: the natural ability of children and parents may be positively correlated (intergenerational ability correlation). Higher-ability parents tend to earn more and have more able children, leading to a positive correlation between parental income and child investment and achievement. The fact that investment and achievement gaps by parental income shrink considerably when differences in maternal ability and education are taken into account suggests that this is likely an important part of the story. However, given that significant achievement and investment gaps remain even after accounting for these maternal characteristics would suggest that other factors are also relevant.

First, parents likely care about more than their children’s future careers when they invest in activities for their children. Parents may just enjoy reading to their children or watching them learn to play a new instrument. They might like to brag about their children’s success in school. If child investment provides a direct benefit to parents above and beyond the future labour market returns to their children, parents will choose to invest more as their income rises, just as they choose to purchase more of other normal goods. Second, low-income parents may invest less in their children because they may be poorly informed about the value of investment activities. They could face uncertainty about (or underestimate) the value of the investments. Third, poor parents may be unable to finance the desired investments in their children if they cannot borrow fully against their own future income or against the potentially high returns that will be earned by their children.

While all of these mechanisms might explain why richer parents invest more in their children than poorer parents, it is important to understand the mechanisms that actually do, because they have very different policy implications. If investment gaps result only from a strong intergenerational ability correlation and/or the fact that parents enjoy investing in their children, policies designed to reduce those differences may be equitable, but are likely to be inefficient (i.e., reduce gross national product). By contrast, if low-income families are poorly informed or constrained in their capacity to borrow, then they may make inefficient, low investments in their children. In this case, well-designed policies can improve both equity and efficiency.

In the paper “Correlation, Consumption, Confusion, or Constraints: Why Do Poor Children Perform So Poorly?” (2015), we examine the extent to which these explanations are consistent with other important empirical findings in the child development literature:

- Fact 1: The return to additional investment for poor children is high relative to the return on savings.

- Fact 2: The return to additional investment is lower for higher income children.

- Fact 3: Unexpected increases in family income lead to greater investments in children and improved childhood achievement.

- Fact 4: Income received when a child is young has a greater impact on achievement and educational attainment than income received when the child is older.

We show that to explain the high returns to additional investment among the poor (Fact 1), information or credit market failures are needed. Absent these market frictions, families will invest until the returns are driven down to or below the returns on savings. The timing of income is only important (Fact 4) if some parents are constrained in their borrowing; otherwise, families can always use borrowing and saving to spend money when they want, regardless of when it is received. If parents with young children are poorly informed about the value of child investments and/or face limited borrowing opportunities, then policies designed to alleviate these market failures can improve efficiency while also improving the economic outcomes for those that are most disadvantaged. What might these policies look like?

Governments can step in to directly provide credit for early child investments (for example, New York City’s recently piloted Middle Class Child Care Loan Initiative) like they do for college students. Subsidized preschool for low-income children can also help address borrowing problems. Programs that help inform low-income parents about the value of talking and reading to their young children or the benefits of attending a quality preschool are steps toward confronting information problems. Together, these common-sense policies can help ensure that economically disadvantaged children face the same potential for lifetime success as their better-off peers.

In addition to the research discussed here, as part of our CIGI-INET grant, “Lifecycle Human Capital Investment, Borrowing Constraints and Risk,” we further study the importance of credit limitations for child development and appropriate policy responses.

Works Cited

Carneiro, P. and J. J. Heckman. 2002. “The Evidence on Credit Constraints in Post-Secondary Schooling.” Economic Journal 112 (482): 705–34.

Caucutt, E., L. Lochner and Y. Park. 2015. “Correlation, Consumption, Confusion, or Constraints: Why Do Poor Children Perform So Poorly?” CIBC Centre for Human Capital Working Paper 2015-3.

Cunha, F., J. J. Heckman, L. Lochner and D. V. Masterov. 2006. “Interpreting the Evidence on Life Cycle Skill Formation.” In Handbook of the Economics of Education, edited by E. Hanushek and F. Welch, Volume 1, Chapter 12, 697–812. Amsterdam: Elsevier.

Keane, M. P. and K. I. Wolpin. 1997. “The Career Decisions of Young Men.” Journal of Political Economy 105 (3): 473–522.