The world is talking about the Group of Seven (G7) again, thanks to the showdown between US President Donald Trump and the six other leaders at the Charlevoix summit in early June. Really, it was only a matter of time before scholars and others resumed wishing for its demise.

“I find myself sympathizing with [Trump’s] skepticism toward the group,” Jim O’Neill, the former Goldman Sachs Group chief economist and long-time champion of emerging markets, said in a commentary for Project Syndicate on June 12. “I have long doubted that the annual meeting of leaders from Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States serves any useful purpose.”

Laments of that sort have existed for years. But O’Neill appears to want to put an end to the grumbling. The newly elected chair of Chatham House challenged other global think tanks to offer “specific ideas” about the future of global governance, and pledged to “lead the charge” himself.

He won’t have a problem rounding up ideas. Last year, David Mulford, a former US ambassador with ties to the Republican Party, explicitly called on the Trump administration to blow up existing institutions and create a new one that would exclude roughly a dozen countries that have grown accustomed to their status as insiders. Trump himself got the conversation started ahead of the Charlevoix summit by stating that Russia should be invited back, an idea endorsed by Italy’s new government.

Before the Group of 20 (G20) became a leaders’ forum in 2008, there was constant criticism of the legacy powers for their refusal to create space at their table for countries such as China and Brazil. That criticism abated when US President Barack Obama announced at the Pittsburgh G20 summit in September 2009 that the bigger group would henceforth be the “premier forum” for international economic cooperation.

The G20 showed early promise. It reversed the financial crisis and Great Recession with the largest coordinated fiscal stimulus the world had seen. It empowered the Financial Stability Board to overhaul international financial governance. Its members kept their promise to resist protectionist trade measures, at least for a little while.

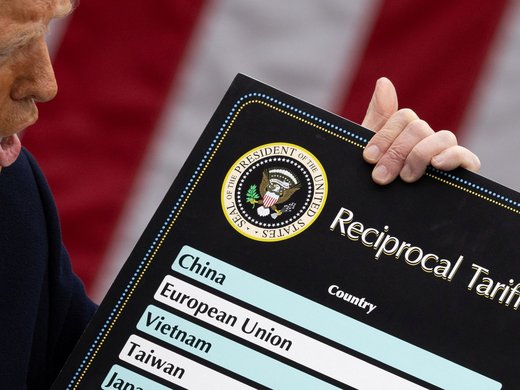

But as the years passed, doubts about the group’s effectiveness started to grow. The G20 had little influence over Europe’s sovereign debt crisis. Protectionist measures began to increase, even as the G20 repeated its pledge to contain them. A promise at the Brisbane summit in 2014 to increase the GDP of the G20 by two percent is no longer discussed. An attempt to organize a reduction in the global steel glut also faltered, emboldening Trump’s push for tariffs on US imports of aluminum and steel.

O’Neill has a unique place in these debates. In a paper almost two decades ago, he created the BRIC acronym to help his clients at Goldman Sachs think about the rise of Brazil, Russia, India and China. His paper captured the imagination of global investors, inspiring the leaders of the countries O’Neill wrote about to get together for a meeting in 2009. They held another one the following year when they added South Africa to their fledgling group. The BRICS will meet for the tenth time in Johannesburg, South Africa, at the end of July.

So, if not the G7, then who? The answer depends on the mission and the plausibility of current alignments being disbanded in favour of new ones.

Mulford would like to radically simplify things. He takes inspiration from the original G5 of France, Germany, Japan, the United Kingdom and the United States, which met for the first time in 1975 to confront the economic fallout of the oil shock. (Canada and Italy joined in 1976.) Mulford would create a modern G5 of China, the European Union, Japan, the United Kingdom and the United States. Its sole job would be to discuss economic matters, as it would be a gathering place for finance ministers and central bankers only.

O’Neill didn’t offer as specific a proposal as Mulford. He thinks the G20 should remain pre-eminent but concedes that a smaller group could be necessary to spur action. If the G7 is the starting point for the creation of a vanguard of leading economies, O’Neill would add China; replace France, Germany and Italy with a single seat for the European Union; and switch out Canada for India. He also wrote that he has doubts about whether the United Kingdom deserves a place on a modern global steering committee, but he didn’t state explicitly that he would banish it from an updated alignment.

It’s undeniable that the G7 has lost the ability to bend the global economy to its will. Still, recent geopolitical events argue in favour of keeping a collection of wealthy democracies together to champion human rights, the rule of law and free trade, all of which are being challenged by a shift to strongmen and demagoguery in various parts of the world.

China’s entry into the World Trade Organization (WTO) was supposed to speed that country’s embrace of democracy. In fact, the opposite has happened, as the Communist Party voted this year to leave President Xi Jinping in place for as long as he wants. Trump’s suggestion of reconstituting the Group of Eight (G8) was ridiculous because President Vladimir Putin has positioned himself as an adversary of the G7. Turkey, an important emerging market, is being run like an autocracy by the country’s president, Recep Tayyip Erdoğan.

So, it’s clear that a beacon of liberalism is still needed. The G7 could perform such a role, although it would need to add to its ranks to be taken seriously, especially in the face of US indifference. French President Emmanuel Macron, who takes over the G7 presidency from Canadian Prime Justin Trudeau in 2019, could secure the group’s future by designing transparent criteria for membership and extending invitations at next year’s summit.

Deciding on an expanded list would be difficult, but hardly impossible. The G7’s strength came not only from its economic clout but also from the members’ complementary world view. A revamped group would be open only to democracies with big economies and a demonstrable commitment to liberal values, such as free trade and human rights.

Shuvaloy Majumdar, once a policy adviser for former Canadian Prime Minister Stephen Harper’s government, and currently a senior fellow at the Macdonald-Laurier Institute, welcomed Trump’s idea of reviving the G8, but argued in a recent Maclean’s article that the president picked the wrong country. Majumdar said the G7 should add India, in recognition of the shift in economic power to the Pacific from the Atlantic, and to offset China.

“Behind the curtain of every optimistic conversation about the economic energy in [Asia] is the profoundly important strategic challenge posed by the rise of China, against the norms of democratic free-market prosperity that the G7 was founded to defend,” Majumdar wrote. “For all of China’s much-vaunted economic progress following the Deng Xiaoping reforms of the 1980s, much of its economy still remains closed, state-driven, and statistically opaque — a trend explicitly intended to continue under the regressive autocracy of President Xi Jinping.”

It’s an intriguing idea, but one based on the notion of what India could be, rather than what it actually is at this stage in its development. India is democratic, but hardly an enthusiastic free trader. When Majumdar calls China “closed, state-driven, and statistically opaque,” he also could be describing India, where the national and state governments maintain outsized roles in economic life and reliable data is thin. India might be an emerging economic force, but it is noticeably absent from the Asia-Pacific Economic Cooperation forum, which demands a certain commitment to open borders in order to belong.

If not India, then who?

Australia is an obvious choice. Its economy is almost as large as Canada’s, and like Canada, it issues a reserve currency, albeit a relatively minor one. Australia is also a member of the Five Eyes intelligence group, along with Canada, New Zealand, the United Kingdom and the United States. It also would offer a unique perspective on China because it is one of the few rich countries that has signed a free trade agreement with the world’s second-biggest economy.

Beyond that, the question is open for debate.

Economic weight should matter. If the threshold for consideration was GDP of at least US$1 trillion, Brazil, Indonesia, Mexico, South Korea and Spain would be candidates. All those countries have demonstrated a commitment to free trade beyond simple membership in the WTO by pursuing regional and bilateral agreements.

To be sure, Brazil, Indonesia and Mexico are plagued by systemic corruption, but the need for legitimacy probably outweighs those concerns, provided their elections are seen to be fair.

Since the financial system is an important matter for this group, Switzerland would be a worthy addition. The Swiss franc also is a reserve currency and Switzerland is home to some of the world’s biggest banks. The absence of an African presence would be problematic, but the continent’s biggest economy, Nigeria, is less than half as large as that of Indonesia, and South Africa’s GDP is smaller than that of Ireland. The African Union could be invited to participate along with representatives of the European Union and institutions such as the International Monetary Fund and the World Bank.

O’Neill noted that the only legitimate claim the G7 has on global leadership is its commitment to democracy. He doubts it is capable of making a difference on issues such as climate change, nuclear proliferation and terrorism without help from other countries.

He is correct on both points, in particular the former.

But no one is expecting the G7 to resolve such existential matters, and there are other structures in place to deal with them. What an enhanced version of the G7 could do is champion liberalism by pushing forward consensus positions that the G20 could never reach. It also would retain significant influence over the global financial system and, to a lesser extent, the digital economy.

The original members of the G7, bolstered by some new partners, could also work on strategies to defend open societies from cyber attacks, a major threat that actually can’t be discussed with China and Russia in the room, because Western authorities suspect that the governments of those two countries sponsor some of the most dangerous hackers.

The G7 still has a reason to exist — maybe more than ever — but it needs to evolve in step with the changing economic landscape.