At the recent G20 meeting, policy makers turned a blind eye to Japanese monetary easing and its impact on the yen exchange rate. In the meantime, Japan’s Finance Minister, Taro Aso, writing in the Financial Times, heralded his government’s attempt to reverse ‘stagnation’ and end the deflation that current Japanese policy makers believe is the source of all their ills. There is, of course, some recognition that the problems facing Japan are fundamentally structural in nature. However, until the government can muster a sufficiently large majority in the bicameral Parliament, the monetary “bazooka” will have to do.

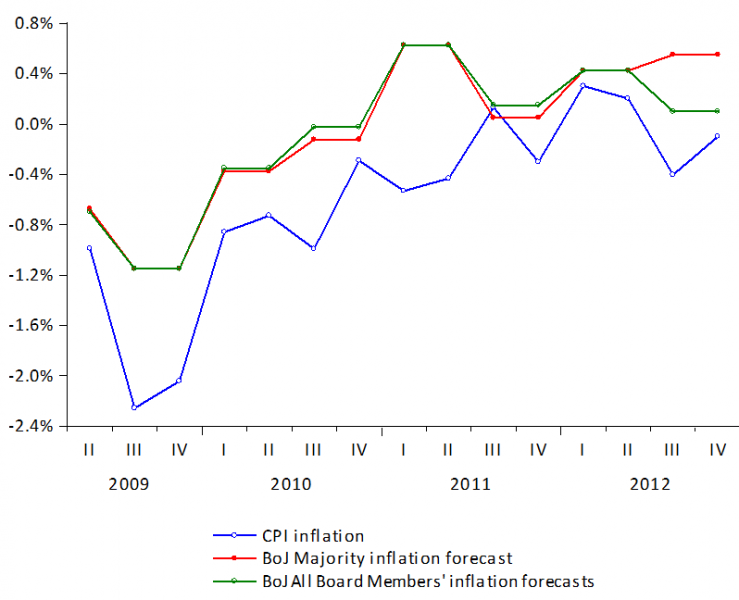

Meanwhile, at the Bank of Japan, it seems that the new Governor has persuaded his colleagues on the Policy Board to substantially revise their inflation and real economic growth outlook. The chart below shows the Board’s view about expected inflation. These views have turned markedly more inflationary since the new Governor took office last month. Indeed, is seems that the center of the distribution predicts a 2% inflation rate, just what the government ordered.

There are only three problems with these turns of events. First, almost none of the promised structural reforms have been implemented, leaving monetary policy to do all the heavy lifting for the time being. Second, when one wades through the Bank of Japan’s Outlook one is confronted with a long list of caveats, that is, reasons why the BoJ may well miss its inflation objective. Indeed, as the graph below shows quite clearly, the Policy Board has been consistently optimistic about inflation since 2009, never coming close to the 1% goal it set out for itself.

Source: Bank of Japan, and author’s calculations. The forecasts are for the mean of the entire Policy Board or for the Majority of its members.

Third, in spite of the publicity surrounding the aggressive loosening of monetary policy by the new Governor, the BoJ’s own forecasts for real GDP growth (see below) do not appear to show the much hoped for growth spurt that the government so dearly wants to generate. Mean growth (the circle in the graph below) is expected to reach an anemic 1.5% in 2014 and 2015. These are hardly exhilarating growth figures.

Perhaps the finance minister and the prime minister are hoping that their optimism will provide an independent boost to the economy. Unfortunately, while the turn in policy in Japan is welcome, and one hopes for its success, there is far too little evidence and it is much too early to conclude that Japan will regain its former glory. As elsewhere in the world, the central banker’s lament that monetary policy cannot fix all our economic problems, is just as valid for Japan as it is elsewhere.