Key Points

- Intellectual property (IP) is an increasingly important source of value for globally competitive companies.

- Canada lags behind peer countries in key metrics such as patent applications per capita and maintains a sizable IP trade deficit.

- Recognizing the growing importance of patents for firm and national competitiveness, a small number of countries created sovereign patent funds (SPFs) intended to help bolster national innovation and IP ecosystems.

- While existing SPFs are highly diverse, a correctly constructed Canadian fund could help address a series of domestic challenges related to IP commercialization and firm growth.

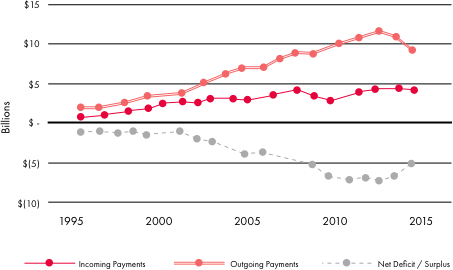

deas transformed into assets through the use of intellectual property rights (IPRs) are increasingly important sources of value in the global innovation economy. Measured in both current US dollars and as a percentage of global GDP, cross-border payments for the use of IPRs have seen strong growth over the past decade.

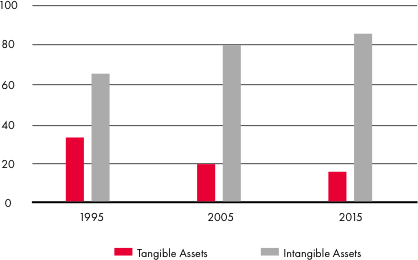

Moreover, while the overall size of cross-border licensing payments remains relatively small as a share of global GDP, IPRs and other types of “intangible” assets are now crucial to the value and strategic orientation of many of the largest and most competitive global firms. According to figures produced by Ocean Tomo (2015), for example, intangible assets — which include IPRs — now account for 87 percent of the market value of Standard & Poor’s (S&P's) 500 companies (see Figure 1). Leading technology firms such as Google, Apple, Microsoft, Facebook, Amazon and Samsung continue to amass large and valuable portfolios comprised of thousands of patents, leading some commentators to express concern about the market and political power of large technology companies.

Figure 1: Source of Market Value (S&P 500)

Concomitant with the rising value and strategic importance of IP, the way in which firms leverage the value of their intellectual resources to generate value in the marketplace has also shifted. While IPRs continue to play an important role in protecting tangible products from being imitated and copied by competitors, they are increasingly leveraged as assets in their own right through strategies based on revenue-focused licensing. As part of the much publicized “smart phone wars,” for example, some analysts have estimated that US-based Microsoft may have generated upwards of US$6 billion annually in royalties connected to approximately 30 licensing deals.1 At the same time, large companies can — and have — used their large IP war chests to deny freedom to operate to competitors, effectively freezing them out of particular markets.

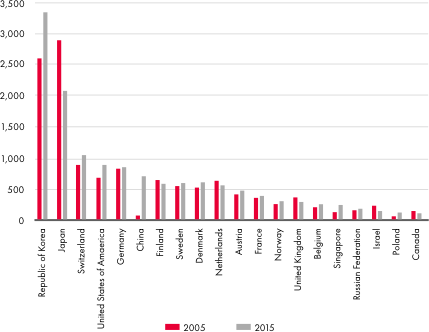

In the emerging ideas economy, Canada is positioned largely as a consumer. Viewed through the lens of input and output metrics, Canada’s IP performance stacks up poorly against peer countries. Canada’s patent applications per capita have declined since 2005 (see Figure 2). In addition, the country maintains a significant IP trade deficit, paying out significantly more in IP royalties than it collects from abroad (see Figure 3).

Figure 2: Patent Applications per Capita (2005 and 2015)

Figure 3: Canada’s Inbound and Outbound IP Payments (Current US$)

In this context, a number of commentators have raised concerns about Canada’s competitiveness in the global ideas economy and called for a national innovation and IP strategy. In testimony before the House of Commons Standing Senate Committee on Foreign Affairs and International Trade in May 2016, Jim Balsillie, former co-CEO of BlackBerry, argued that “Canada owns and exports very little intellectual property because (the country has) never had a national innovation strategy” (Standing Senate Committee on Foreign Affairs and International Trade 2016). In a similar vein, other commentators have highlighted Canada’s less-than-stellar record of commercializing new technologies and turning start-up companies into rapidly scaling, globally competitive firms.2

As part of the emerging debate on innovation strategy in Canada, several commentators have highlighted the potential benefits for Canada in following the lead of other jurisdictions — notably South Korea, Japan and France — in creating a state-backed or “sovereign” patent fund. The remainder of this essay will provide an overview of the SPF concept and explore its potential applicability in the context of a Canadian innovation strategy.

What Are SPFs?

Emerging in the last five years in a small handful of countries that are members of the Organisation for Economic Co-operation and Development, SPFs can be broadly defined as state-backed investment vehicles that acquire IPR assets from third parties in service of national economic objectives.3 Existing funds have been capitalized from public and/or private sources in the range of CDN$100–$500 million, with some funds receiving further investment from private firms or individuals. These funds have leveraged this capital to acquire significant portfolios of patents — principally in the United States — although the size of their portfolios and the mechanism through which they acquire IPRs varies widely.

Indeed, although falling within the same genus or organizational “type,” existing SPFs operating in France, South Korea and Japan embrace a diverse array of structures, objectives and strategies. In terms of objectives, these may include — but are not necessarily limited to — the following:

- Defensive objectives, including protecting domestic companies from aggressive litigation on the part of patent assertion entities and helping to secure freedom to operate for participating technology companies.

- Commercialization objectives, including helping small and medium-sized enterprises (SMEs) and public research organizations (PROs) realize the value of their existing IP through licensing and — where necessary — litigation. Existing funds have emphasized building new, emergent value by bundling together separate IPRs into distinct technology clusters, thereby removing barriers between potential licensors and licensees.

- The provision of high-quality IP expertise to high-potential start-up and scale-up firms that might not otherwise be able to access it.

- International trade objectives, including the prevention of “IP flight” in the event of firm bankruptcy as well as the retention of publicly developed IPRs from post-secondary institutions and other PROs.

Existing funds have tended to embrace at least some of these objectives, and have subsequently deployed a variety of strategies in service of their overarching goals.4 Japan’s IP Bridge, which is a public-private partnership funded by the Innovation Network Corporation of Japan, has focused heavily on the commercialization of dormant or “sleeping” patents held by Japanese firms. While Japanese companies continue to hold sizable portfolios of valuable IP, they have been more reluctant than their American counterparts to monetize these assets through licensing and open innovation practices.5 Using a revenue-sharing arrangement that has allowed the fund to acquire a significant number of patents from large Japanese companies, Japan’s IP Bridge has aimed to close that monetization gap in order to help these firms fund subsequent research and development activity.

In contrast, the French fund France Brevets has emphasized licensing patents with rights to sub-license and, as a result, directly holds a significantly smaller number of patents than either the Japanese or Korean funds. Since France does not boast a roster of large technology champions holding vast troves of valuable IPR comparable to that of Japan, the French fund has instead focused on bundling together more disparate IP resources from smaller players. France Brevets has been active in both licensing and — to a lesser extent — litigation, in particular on a series of patents in the area of near-field communications developed by the French firm Inside Secure.

SPFs can be broadly defined as state-backed investment vehicles that acquire IPR assets from third parties in service of national economic objectives.

South Korean fund Intellectual Discovery emerged initially out of defensive concerns, with particular emphasis on the potential acquisition of Korean-produced IP and its assertion against domestic companies. Indeed, the arrival of the large private patent fund Intellectual Ventures partially motivated the creation of the similarly named Intellectual Discovery in 2010. While Intellectual Discovery has continued to emphasize the defensive aspects of its mission through the operation of a subscription-based defensive patent pool, the fund’s mission has evolved and expanded over time.

What Could an SPF Do for Canada?

The potential for a made-in-Canada SPF is an increasingly hot topic. As the previous section highlighted, the broad SPF model encompasses a significant degree of variation in structure, objectives and strategies designed to address specific country-level priorities and challenges. In this context, a provincial or pan-Canadian fund could work to address Canada’s IP commercialization gap. Simultaneously, such a fund could also provide a degree of defensive security for the type of small-but-scaling Canadian companies that are likely to become the target of aggressive litigation. As part of broader national and provincial efforts to support high-potential firms with the ability to grow into future Canadian technology champions, the fund could act as a mechanism to provide access to high-quality IP expertise. Finally, the presence of return-on-investment (ROI) objectives can provide a degree of discipline to expenditures as well as a base for continued investments.

Canada’s public research bodies, as well as small firms, often struggle to realize the full value of the IP assets they hold. With respect to university-generated IP, for example, recent research by Karima Bawa (2016) highlights that the “number of spinoff companies and revenues generated by commercialization activities is insignificant when compared to public investment in universities for R&D [research and development].” The problem is equally prominent in the start-up and scale-up communities, where knowledge of IP issues tends to be scarce. Indeed, smaller players are at a disadvantage in IP monetization both because the process of asserting their rights against larger players is resource-intensive and uncertain and because the value of IP is often contingent, meaning that the value of specific IP is enhanced when “bundled” with complementary assets. If correctly conceived, a Canadian-focused SPF could help ameliorate these size-specific disadvantages and help firms generate revenue that could be channelled back into productive purposes, such as the development of human or intellectual capital.

If correctly conceived, a Canadian-focused SPF could help ameliorate these size-specific disadvantages and help firms generate revenue that could be channelled back into productive purposes, such as the development of human or intellectual capital.

From a more defensive perspective, a provincial or national SPF could help provide a degree of protection to start-ups and scale-ups and help them secure freedom to operate in targeted technology sectors. This could be done most directly through the creation of a subscription-based defensive pool similar to that operated privately by RPX Corporation. Such a pool-based model may help deter litigation by establishing a credible threat of countersuit. More broadly, the fund could seek to acquire and encumber strategic IP from third parties, preventing these from falling into the hands of aggressive patent trolls or other entities.

The provision of IP expertise to high-potential companies at a reduced cost represents another advantage of the SPF model. Lack of awareness, knowledge and expertise about IP issues has consistently been identified as a problem for Canadian firms, in particular SMEs. In this context, the 2013 report on Canada’s Intellectual Property Regime from the Standing Committee on Industry, Science and Technology recommended that the government “actively engage with Canadian businesses to raise awareness of IP rights and provide greater support to business seeking to protect their IP” (Standing Committee on Industry, Science and Technology 2013). Outside the public sector, similar concerns have motivated initiatives such as pro bono legal clinics and the Centre for International Governance Innovation’s recently launched massive open online course focused on foundations of IP strategy. In this context, an SPF represents a mechanism to deliver high-quality strategic advice and expertise to companies with the potential to scale up.

Finally, the ROI objective provides a degree of discipline that is often not present in other types of innovation support programs. Prominent authors in this area such as Mariana Mazzucato (2014; in particular chapter 9) have highlighted the problem of “socialized risk and privatized reward” inherent in many programs that directly or indirectly deploy public funds to support innovation. While progressive corporate tax systems may address this issue to some degree, the mandated ROI component of an SPF helps to both discipline the provision of supportive investment and orient decisions toward generating a fair return for public dollars that can then be reinvested in further R&D supports.

Conclusion

The preceding analysis suggests that the creation of an SPF could form an important part of a Canadian innovation strategy. As some of the recent difficulties experienced by existing SPFs highlight, however, simply creating such a fund is likely insufficient. Instead, to be successful, such an initiative at either the federal or provincial level will need to be appropriately funded, structured and staffed. Most importantly, the objectives and strategies of the fund must be tailored to address specific Canadian challenges in the area of IP commercialization and the scaling up of high-potential technology companies. If constructed in this way, a state-supported patent investment vehicle could play an important role in supporting Canadian innovation.

Acknowledgement

The author would like to acknowledge and thank Peter Cowan and James W. Hinton for their ongoing input, advice and expertise on the topic of a Canadian SPF.