Key Points

- The Group of Twenty (G20) has recently recommitted itself to exploring innovation as a driver of growth with the release of the G20 2016 Innovation Action Plan. While the action plan refers to collaboration and the sharing of best practices, it does not identify the specific actions directly linked to achieving innovative growth.

- Best practices for encouraging innovation need to consider the role of uncertainty. Forthcoming research by CIGI breaks down this relationship and finds evidence of a link between increased uncertainty and decreased research and development (R&D) activity by business enterprises.

- The G20 should encourage members to pursue agreements and policies that minimize the effect of uncertainty on business enterprise R&D (BERD) efforts. These include: a World Trade Organization (WTO) agreement to neutralize the escalating strengthening of intellectual property rights (IPRs); disclosure and licensing policies for standard-essential patents (SEPs); implementation of Basel III requirements and other supporting regulatory reforms; and increased tax credit incentives and direct subsidies to mitigate the negative effects of remaining uncertainty.

ubdued global economic growth following the global financial crisis (GFC) has increasingly led politicians and policy makers to focus on the importance of longer-term sources of growth, beyond the immediate goal of achieving and maintaining macroeconomic stability. Along these lines, the G20, the highest consultative mechanism among leaders from systemically important economies, has started to broaden its agenda to investment, mainly in infrastructure and, only very recently, in innovation.1

This essay reviews this emerging agenda item and how it has featured in recent G20 summits, and recommends a set of policy measures through which the G20 can encourage more investment in innovation, including by reducing uncertainty. In doing so, it draws heavily from ongoing research in CIGI’s Global Economy Program and, in particular, from a forthcoming paper by Olena Ivus and Joanna Wajda (forthcoming 2017).

The thrust of this essay is that — within its current remit and over the longer term — the G20 has the potential scope to undertake a more ambitious agenda, even though — in the shorter run — some key members may decide to engage less with this forum.

Subdued global economic growth following the GFC has increasingly led politicians and policy makers to focus on the importance of longer-term sources of growth, beyond the immediate goal of achieving and maintaining macroeconomic stability.

Investment, Innovation and the G20

Although innovation was highlighted by the G20 as a “core value” during the early stages of the global recovery from the GFC (G20 Leaders 2009), its promotion lost primacy over the ensuing years, before regaining a prominent role in 2016 at the Hangzhou summit.

More specifically, the Pittsburgh summit communiqué emphasized the G20 members’ “responsibility to…promote entrepreneurship and innovation across countries” as a “key principle” (ibid.). Subsequently, in Toronto in 2010, G20 leaders reinforced their agreement regarding a series of measures aimed at unlocking demand, including to “encourag[e] innovation” (G20 Leaders 2010). Brief references with respect to investment in innovation followed in Los Cabos (2012), St. Petersburg (2013) and Brisbane (2014).

In Antalya, Turkey, in 2015, emphasis was placed on small and medium enterprises as “important engines of innovation” (G20 and Organisation for Economic Co-operation and Development [OECD] 2015a). Accordingly, a joint G20 and OECD report on G20 investment strategies suggested that promoting further productivity and innovation, including through R&D programs, could prove an effective investment strategy (G20 and OECD 2015b, 10). A notable shift was then witnessed in Hangzhou in 2016, where leaders incorporated innovation-related spending as a priority.2 Even more so, the Hangzhou summit communiqué affirmed a commitment by the world’s systemically important economies to prioritize investment for innovation purposes: “We recognize that in the long run, innovation is a key driver of growth for both individual countries and the global economy as a whole. We are committed to tackling one of the root causes of weak growth by taking innovation as a key element of our effort to identify new growth engines for individual countries and the world economy, which will also contribute to creating new and better jobs” (G20 Leaders 2016).

With this in mind, G20 leaders endorsed the G20 Blueprint on Innovative Growth and the G20 2016 Innovation Action Plan. The Innovation Action Plan is based on five general tenets,3 with much of the G20’s involvement revolving around facilitating discussion and encouraging cooperation, far removed from specific actions directly linked to the end goal. At any rate, G20 leaders see the organization as the forum most capable of driving forward innovative growth, largely due to the capacity of its members to do so: “the G20, as a premier forum for international economic cooperation, comprises the world's leading economies, with 90% of global GDP, more than 80% of global R&D investment and 70% of the global patent applications. The G20 members fully recognize the importance of embracing a dialogue on innovation in existing cooperation fora to encourage innovation-driven growth and foster a strong and sustained world economy.”4

Uncertainty and Innovation

An upcoming CIGI paper examines the link between uncertainty and innovation in G20 countries.5 In particular, it focuses on macro uncertainty: the extent to which households and businesses are less able to predict future economic conditions. Five proxies are used: stock index daily returns volatility, cross-firm daily stock return spread, sovereign bond yields daily volatility, exchange rate volatility and GDP forecast disagreement.6 These measures reflect disagreement among investors and experts on stock prices and business performance, interest rates, inflation, exchange rates, growth and general economic conditions — all factors businesses need to take into account when making investment decisions, including investment in research.

As for innovation, it can be measured through its inputs and outputs, including R&D expenditure, patents, science and technology skills and education, product turnover, and diffusion of new technologies. R&D expenditure7 was chosen for three key reasons: ease of measurement, connection to a strategic business decision and timing. By using R&D expenditure, there is no significant delay between the business decision and the time of measurement, as would be the case with patents (which would obfuscate the connection between the business decision and the level of uncertainty at the time).

The analysis looks at changes in the level of R&D expenditure, but also the changes in R&D expenditure as a share of GDP (referred to as R&D intensity), to control for the fact that larger countries tend to spend more on R&D; otherwise, the results would be disproportionately driven by the relationship between uncertainty and innovation in larger countries. This resolves one issue, but introduces another: GDP is also affected by uncertainty, as uncertainty is higher in recessions. For this reason, both aspects need to be explored. The overall level of R&D expenditure is the gross domestic expenditure on R&D (GERD); two (overlapping) subclasses are looked at further: business enterprise expenditure on R&D and government-financed GERD.

Moreover, the uncertainty measures are normalized so that they have a mean of zero and standard deviation of one for each country, and are reported in deviations from the mean. When we think about uncertainty, it makes sense that some countries may inherently face greater uncertainty and/or greater volatility of uncertainty. If such conditions are the standard, we would expect businesses in those countries to treat it as such and not change their behaviour. Normalizing the uncertainty measures means looking at changes in uncertainty that are not within the historical norm of that country, or “unexpected uncertainty.”

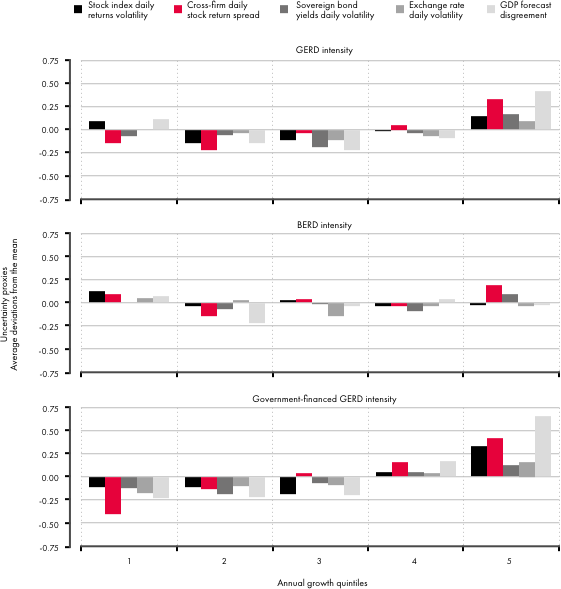

The annual growth rates of R&D and deviations from the mean in uncertainty are the underlying data of Figures 1 through 3. The country-year pairs are sorted into quintile “bins” according to annual growth (of R&D, GDP or R&D as a percentage of GDP) on the x-axis. The average of the unexpected uncertainty is calculated for all observations assigned to each bin.8 The figures examine three perspectives on the possible relationship between changes in uncertainty and R&D growth: the effects on R&D intensity; the direction of effects on the numerator (GERD) and denominator (GDP) of GERD intensity; and the effects on R&D expenditure. Figures 1 and 3 also account for differences in the effects on R&D in general, R&D performed by business enterprises (BERD) and R&D funded by the government.

While the first panel of Figure 1 indicates a positive relationship between all the uncertainty proxies and R&D investment relative to GDP, the third panel shows that government-financed R&D expenditure is likely the key driver, and not the R&D investment behaviour of business enterprises.

Figure 1: Uncertainty and R&D Intensity by Type

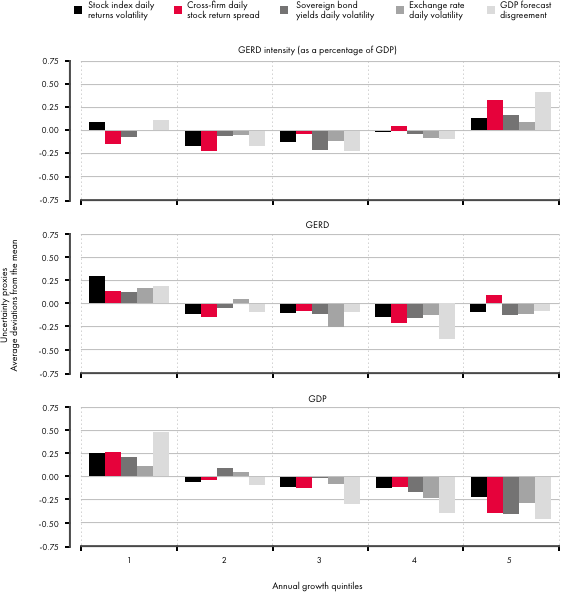

Figure 2 takes the data from the top panel of Figure 1 and repeats the exercise for the numerator and denominator of GERD intensity separately. It is immediately apparent that while higher GERD intensity growth is linked to higher uncertainty, the opposite is true for GERD (R&D expenditure) and GDP. Both R&D growth and GDP growth are higher in times of lower uncertainty, but the effect on GDP appears stronger, leading to the positive correlation seen with growth of R&D intensity.

Figure 2: Uncertainty, GERD and GDP

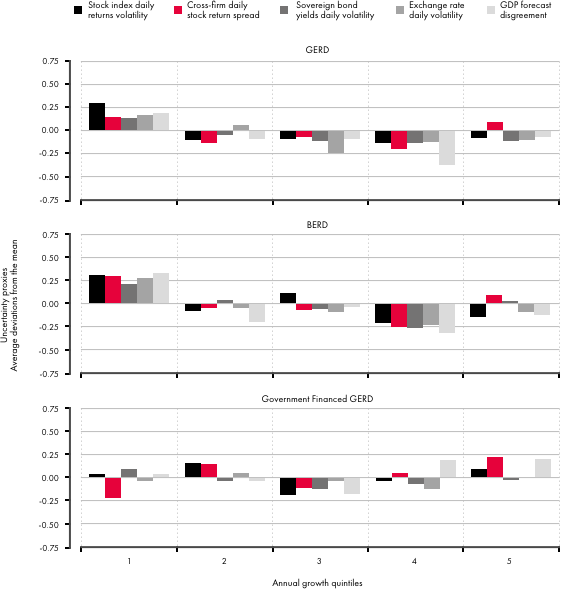

Given the pattern observed in Figure 2, Figure 3 presents the correlation between the change in uncertainty and the three R&D expenditure measures, not as a percentage of GDP. R&D expenditure in general and R&D expenditure by business enterprises are higher in times of lower uncertainty, but the relationship between uncertainty and government-financed R&D is ambiguous.

Figure 3: Uncertainty and R&D Expenditure by Type

Summing up, the implications of these graphs should be clear: as expected, increased uncertainty is correlated with decreased growth overall, but it is also correlated with decreased growth in R&D expenditure (and, crucially, with decreased growth in BERD. There are a number of theoretical explanations for this relationship, which is explained in more detail in Ivus and Wajda (forthcoming 2017). The two key explanations are the increase in the value of delay and the irreversibility of R&D investment. These two concepts are not unrelated, and some irreversibility is typically required for uncertainty to increase the value of delay; for instance, using data on Italian manufacturing firms, Stephen R. Bond and Lombardi (2006) find a weaker response of investment to demand shocks at higher levels of uncertainty under partial irreversibility.

Does government support of R&D overcome these effects? Ivus and Wajda (forthcoming 2017) indicate that it does not: while government financed about 41 percent of domestic R&D, it financed only 11 percent of BERD. Furthermore, it does not appear that government financing of R&D is higher when there is greater uncertainty. It is, therefore, not surprising that such a strong negative correlation is seen between BERD growth and increased uncertainty.

Conclusion

Effective systems of IPRs can help attenuate some of the negative impacts of uncertainty on business R&D spending, by increasing the reversibility of the investment through selling the IPR. However, this is a double-edged sword: overly strong IPRs can incentivize patenting of weak innovations, leading to greater costs and uncertainty in the due diligence process and greater threat from non-performing entities seeking to extract rents from successful firms.

Recommendation One: The G20 should encourage the creation of a WTO agreement to neutralize the escalating strengthening of IPRs within international trade agreements.

National interests have led to the strengthening of IPRs globally beyond efficient levels for a knowledge-based economy. Innovators face greater uncertainty as it becomes increasingly difficult to be non-infringing amid a tangled web of patents, some owned by exploitative non-performing entities. An effective agreement would include disciplines on the creation of IPRs by national authorities and a timely elimination process for non-performing patents that burden the system, and provide an international court to settle cross-border infringement claims (Ciuriak 2017).

Recommendation Two: The G20 should urge its members to adopt disclosure policies on fees and royalty rates9 and the Electrical and Electronics Engineers Standards Association’s (IEEE’s) new licensing policy10 for SEPs.

Adherence to official standards is a requirement for success in certain markets, but is complicated by discriminatory licensing of SEPs. These recommendations are particularly important not just for leaders in the SEP market (that is, the United States), but also for emerging contenders in SEPs such as China (Ernst 2017).

R&D support programs typically show high public return11 and counteract the negative effects of uncertainty on R&D investment. Along these lines, Dirk Czarnitzki and Andrew A. Toole (2007) find that the positive effects of subsidies on the return for R&D investment in German manufacturing firms mitigate the negative effects of product market uncertainty.

Recommendation Three: G20 members should review their R&D support programs and increase tax credit incentives and direct subsidies.

Uncertainty decreases investment in R&D in the present by increasing the relative value of delay — the literature shows this effect is magnified in the presence of financial constraints and distortions in financial markets (Arellano, Bai and Kehoe 2010; Christiano, Motto and Rostagno 2014; Gilchrist, Sim and Zakrajšek 2014). In a broader perspective, the international financial crisis that struck in 2007-2008 profoundly increased uncertainty, and massively weakened investment in innovation throughout the world. Since 2008, the G20 program to reform the global architecture of financial regulation, coordinated by the Financial Stability Board (FSB), has greatly strengthened the solvency, liquidity and risk management of banks and other institutions to reduce financial uncertainty. It has also begun to transform the shadow banking system into a safer and more efficient market-based system for funding private investment.

Recommendation Four: With financial regulatory reform now beginning to reduce global uncertainty and foster greater resiliency in the global financial system, G20 member countries must maintain the momentum of reform, not only by fully implementing the Basel III requirements for the solvency, liquidity and risk management of banks, but also by addressing important supporting regulatory reforms in other areas, including the FSB’s proposed actions to transform shadow banking into a more robust system of market-based finance.

Such efforts should also include the strengthening of collateralization, margining practices and the capitalization of central counterparties in key fixed-income and derivatives markets. Continued financial regulatory reforms in these areas are essential elements for reducing general uncertainty and thereby strengthening the incentives for the expenditures on R&D that will foster stronger innovation over the longer term. It is crucial that the momentum of regulatory reform promoted consistently by the G20 since 2009 does not weaken just when it is about to contribute importantly to financial stability and, through that, to potentially stronger innovation and productivity growth.