This conference paper considers the scale of the global digital economy including cross-border activity. Digital trade is challenged by an inconsistent and incomplete multilateral regulatory framework anchored by the World Trade Organization (WTO) and an emerging patchwork of regional and bilateral accords with multiple points of convergence and divergence. To gauge the economic implications, the analysis examines an illustrative case of digital services market openness and intellectual property (IP) protection, seen in relation to innovation indicators. Conclusions point to possible steps to advance liberalization within the bounds of regulatory guardrails.

Starting Point

The international digital economy has grown to a massive scale, operating in the context of an inconsistent and incomplete governance framework cobbled together at the multilateral, regional and bilateral levels. Concerns from government, civil society and business about some aspects of cross-border digital trade have fuelled interest in closing regulatory gaps, aligning requirements and facilitating digital trade while maintaining an appropriate balance of interests. The scope, dynamism and transformative potential of digital trade lends urgency to the construction of an improved regulatory framework for liberal, lean, rules-based market access. This matters for the promotion of innovation and sustainable economic growth.

Digital Dynamics

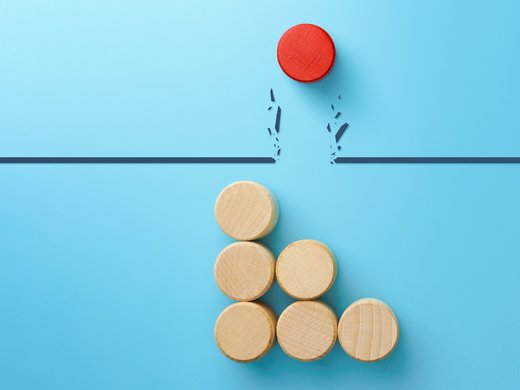

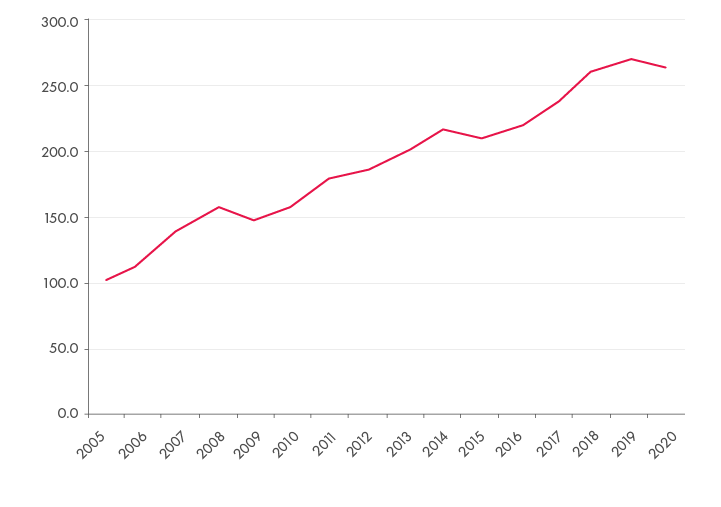

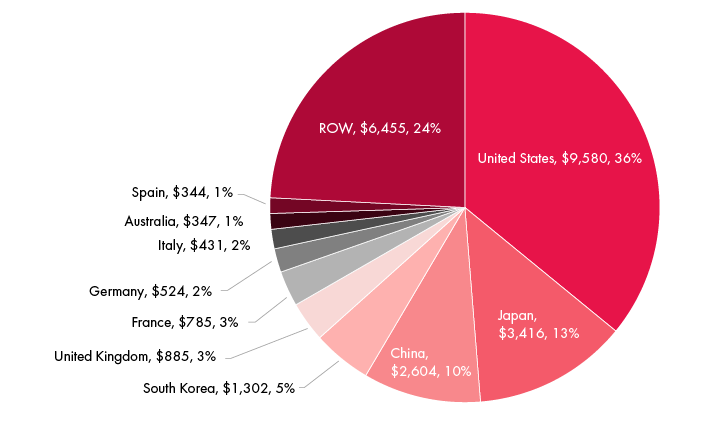

Figures 1, 2 and 3 present a few data points to illustrate the scale and dynamics of the international digital economy. According to the United Nations Conference on Trade and Development (UNCTAD), nearly 1.5 billion consumers shopped online in 2019, up 16 percent from 2017 (UNCTAD 2020, 6). Some 360 million people were cross-border e-shoppers in 2019 (Figure 1). And while UNCTAD estimated worldwide e-commerce retail sales to be US$3.4 trillion in that year, business-to-business (B2B) e-commerce sales were estimated to be some 3.5 times greater at roughly US$12.2 trillion.1 Figure 2 highlights the growth in digitally deliverable services trade, which grew by more than 2.5 times between 2005 and 2020 to reach nearly US$3.2 trillion (UNCTAD 2021a). And Figure 3 highlights the scale of leading players in e-commerce as of 2019. The United States accounts for more than one-third of the total global e-commerce sales volume of US$26.7 trillion (UNCTAD 2020, 4). The US e-commerce sales of US$9.6 trillion equate in value to some 45 percent of US GDP. The goal of these illustrations is not a comprehensive treatment of the digital economy, but rather to give a sense of its dynamism and scale. Digital trade is large enough that its facilitation or disruption can have substantial repercussions for the world.

Figure 1: Worldwide Online Retail Shoppers, Billions, 2017–2019

Figure 2: World Digitally Deliverable Services Trade (Imports and Exports), Index

Figure 3: Total E-commerce Sales (B2B and B2C) by Country, US$ Billion and % of Global Total, 2019

Digital Trade Governance

When considering governance of the trading system, trade economists have traditionally tended to favour the development of a global non-discriminatory set of rules that supports market openness and regulatory transparency, while imposing disciplines to rein in harmful actions and costly economic distortions. Yet digital trade remains governed in a rather fragmented and incomplete manner by institutions at the global level. Progress at the WTO, with its large and diverse membership, has been slow. To close the gaps, policy makers in leading economies have turned their attention to regional and bilateral deals. On one hand, these smaller groups of economies have found it less difficult to build consensus and advance. On the other hand, some nations have threatened unilateral actions where their concerns are not addressed.

The WTO plays a key role as a forum for discussion, negotiation, policy review, trade statistics and dispute resolution with respect to WTO commitments. Concrete instruments include the Information Technology Agreement (ITA) (duty-free treatment for most electronics products) and the General Agreement on Trade in Services (GATS) (for example, supporting access in some markets to information and communications technology services).2 In relation to data transmissions, since 1998, WTO members have so far prevented imposition of duties via a temporary moratorium generally renewed biennially (WTO 2019).3 The WTO Trade Facilitation Agreement is supporting digitization of some customs processes, as well as improving transparency and streamlining red tape (WTO 2017). Soon, perhaps, the WTO’s Joint Statement Initiative on e-commerce, with 86 members currently participating, may deliver an “opt-in” accord for improved procedural and regulatory transparency and e-trade facilitation.4

The UN system has played a complementary role with measures to facilitate digital trade and monitor developments. The UN Commission on International Trade Law (UNCITRAL) has developed legal tools such as the Model Law on Electronic Commerce (1996, 1998).5 UNCTAD provides an important digital economy monitoring function on issues such as e-commerce preparedness (i.e., availability of personal financial accounts, online experience of the population, access to secure internet and postal service reliability); policy recommendations; and digital trade statistics.6 The UN regional commissions, such as the UN Economic Commission for Europe (UNECE), have also supported rulemaking, analysis and statistics in areas such as cybersecurity.

The Group of Twenty (G20) provides an annual forum for high-level policy development and co-ordination for government leaders among the large economies. Key stakeholder groups provide annual input reports outlining prioritized analytical and advocacy perspectives, often covering digital economy issues. The groups represent labour, business and think tanks, among others. With its light and agile structure and its de facto convening power, the G20 is likely to remain at the leading edge for international coordination on substantial digital economy policy developments.

The Group of Seven (G7) serves as an informal forum for the leaders of seven advanced democratic economies (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States), plus the European Union. It operates on an annual cycle with a rotating presidency among the members. While its decisions are not legally binding, they do have political influence. The digital economy has been a recurrent item on the G7 agenda. On October 22, 2021, the G7 trade ministers issued a set of digital trade principles. These consolidate elements from digital trade chapters of G7 trade agreements (discussed below). The principles affirm open digital markets; free data flow with trust (i.e., with data protection); safeguards for workers, consumers and businesses; digital government services; and fair and inclusive global governance engaging the WTO, the Organisation for Economic Co-operation and Development (OECD), and the World Customs Organization. The G7 principles promote shared regulatory approaches, interoperability of government systems and disciplines on government access to personal data (UK Department for International Trade and Trevelyan 2021).

The OECD provides policy support for most areas of government except culture and defence. The digital economy is a cross-cutting concern.7 OECD methods include soft law and policy recommendations, policy monitoring and analysis, peer review, statistical tracking and outreach. Members have promulgated formal recommendations on issues such as Electronic Authentication (2007), Consumer Protection in E-Commerce (2016), and Enhancing Access to and Sharing of Data (2021).8 In a major achievement in 2021, negotiations held at the OECD in cooperation with the G20 resulted in an accord among 136 jurisdictions on the taxation of cross-border digital services, fixing a minimum corporate tax rate and apportioning the right to tax profits made in an economy even if the firm lacks a physical presence (OECD 2021a). This accord should reduce tensions on these issues, with entry into force expected in 2023.

In 2021, an OECD inventory of legal instruments related to international e-commerce found 52 different instruments administered in 24 different bodies (OECD 2021b). The most active rulemaking bodies included the WTO, OECD, International Organization for Standardization/International Electrotechnical Commission, UNECE/United Nations Centre for Trade Facilitation and Electronic Business, and UNCITRAL. Other organizations especially active in digital trade matters include the World Customs Organization, World Bank, International Monetary Fund, Asia-Pacific Economic Cooperation (APEC) and International Telecommunication Union.

Regional and Bilateral Trade Agreements

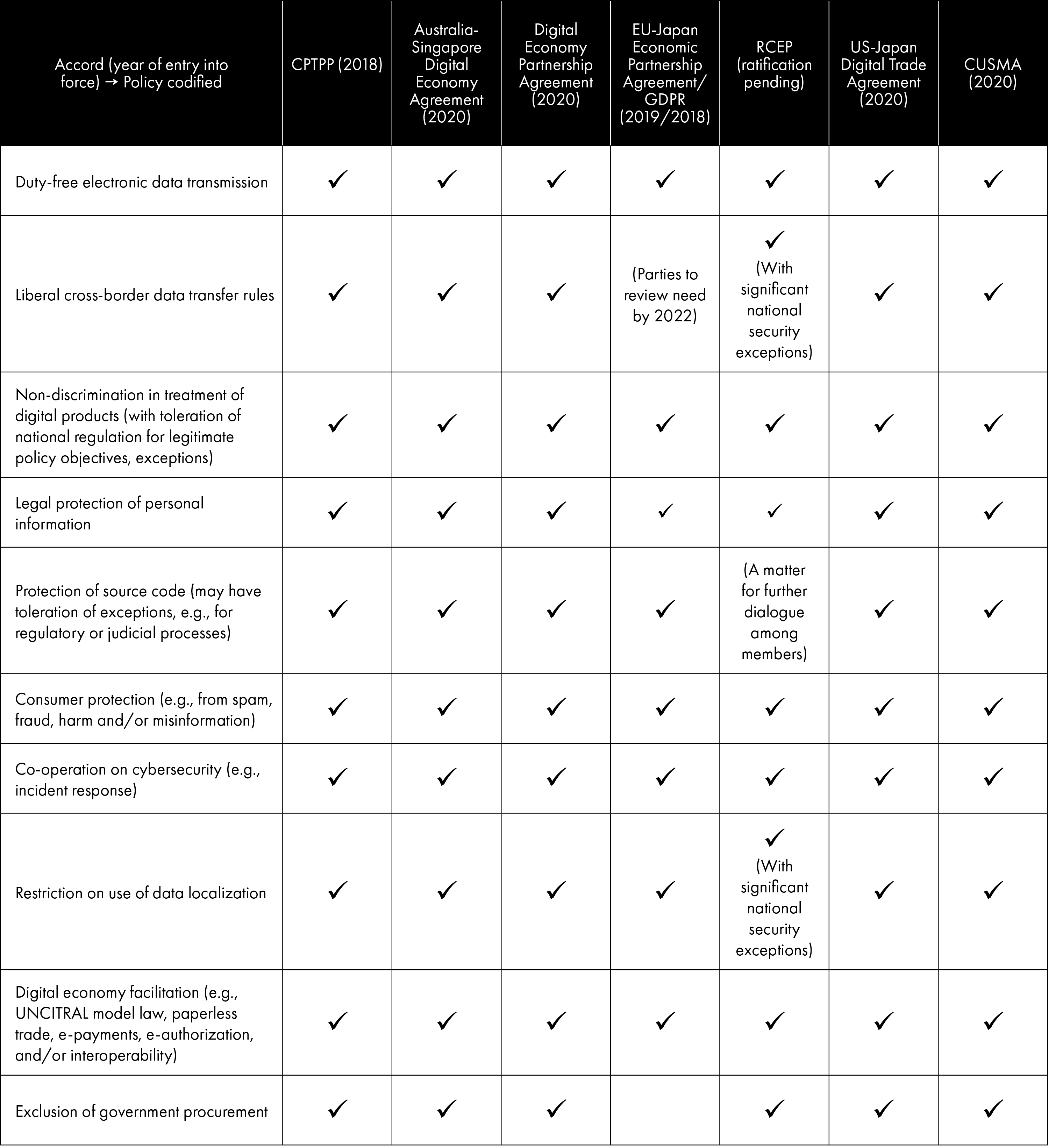

Our review of seven recent trade accords touching on digital trade (Table 1)9 revealed three main approaches emerging, albeit with points of alignment and divergence. The United States, the European Union and China are leading advocates that emphasize, respectively, market openness with regulated, business-led control of data; commercial openness with user-led control of privacy and data; and commercial openness with state-defined privacy protection, and some elements subject to subordination to national security interests.10 Across the accords, one finds some points of convergence on duty-free treatment for electronic transmissions, consumer protection, e-trade facilitation, exclusion of government procurement and cooperation on digital trade. Most of the agreements were also fairly close on cross-border transfer of data for the conduct of business, non-discrimination for digital products, protection for software source code, cybersecurity and prohibition of data localization requirements, albeit subject to various carve-outs and exclusions. In the case of the Regional Comprehensive Economic Partnership (RCEP), however, negotiators agreed to expansive exceptions to the liberal cross-border flow of data and disciplines on data localization, and the non-discrimination terms are less stringent. And RCEP does not provide protection of source code. Differences also remain between the European Union and the United States on privacy matters. They have struggled to find a legally solid standard on data transfers and protection of personal information (Propp 2021).

Interestingly, some third countries have found means to bridge among the leading nations. Japan, for example, is party to a bilateral trade deal with the European Union, an Asian regional trade deal anchored by China (RCEP); a bilateral digital trade agreement with the United States; and a formerly US-led Pacific Basin trade deal (the Comprehensive and Progressive Agreement for Trans-Pacific Partnership [CPTPP]). And Canada has a deal with the United States and Mexico (the Canada-United States-Mexico Agreement [CUSMA]), another with the European Union and is a party to the CPTPP.11 The experience of Japan and Canada, along with a few others, may provide an indication that some increased alignment across regional trade agreements, perhaps even multilateralization of some provisions, may be feasible with further negotiation. And there are further high-standards accords in the works (for example, between the European Union and Australia).

Private Sector

The private sector is, of course, the central player in the conduct of digital trade. Geopolitical tensions, new technology, economic turbulence and the coronavirus disease 2019 pandemic have fuelled expanded regulatory standards,12 driven digitization of processes and increased economic pressure on firms. Businesses are responding. Trade finance provision is being digitized to offer greater security (“know your client”), new client services and timeliness.13 Global value chain operations are shifting focus from efficiency to also include resilience and robustness.14 These developments are requiring deeper integration of digital functionality. This is still a work in progress, in part, because regulators are not all on the same page (for example, in acceptance of e-documentation). The key point here is that the private sector stakeholders are critical counterparts to government in the emerging governance framework for digital trade.

Table 1: Illustrative List of Areas of Convergence across Various Current Digital Trade-Related Agreements

Empirical Assessment

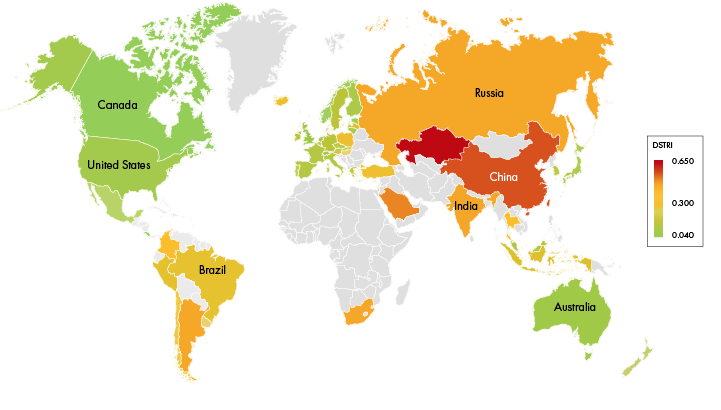

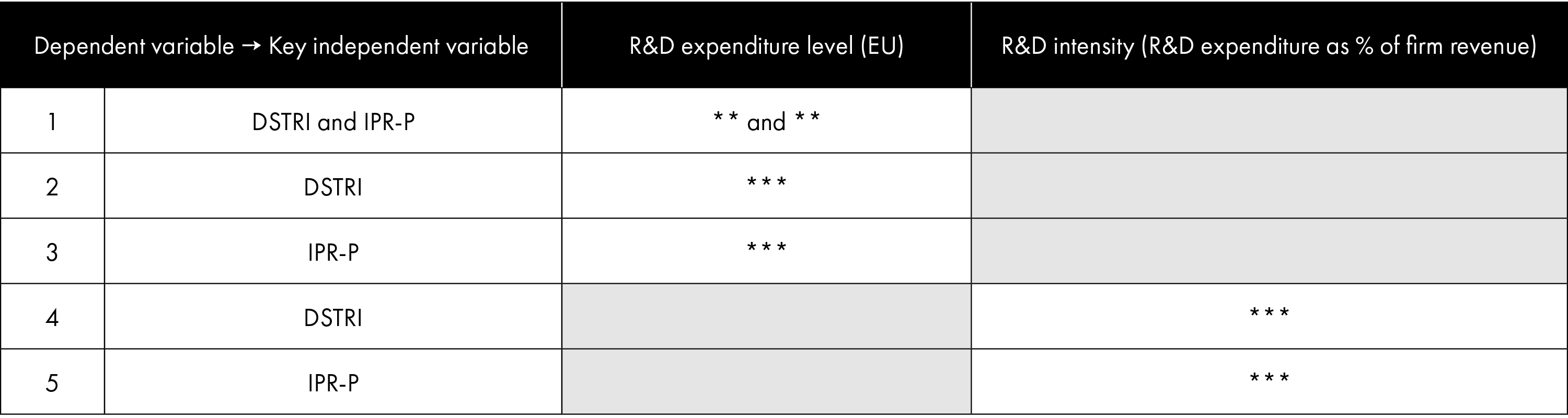

Drawing on an OECD policy indicator, Figure 4 highlights variation in the extent of digital services market openness across 50 countries. Using a data set covering firm-level research and development (R&D) in top firms globally during the period 2014–2019 (European Commission 2019), we examined the relationship to digital services market openness, controlling for other factors. Both R&D expenditure and intensity15 were found to have a strong, statistically significant, positive association with national-level digital services market openness, controlling for other factors (see Table 2). Our further analysis found a similar association of these R&D indicators with protection of IP rights. Moreover, economic literature confirms that R&D expenditure is positively associated with innovation outputs such as patents (an indicator of technological progress), which unlock future economic growth potential. These positive effects hint at the economic importance of advancing rules-based digital services market openness within the bounds of regulatory guardrails and appropriate levels of IP protection. While correlation in these regression assessments does not demonstrate causality, it does provide a useful starting point for further, more comprehensive analysis. This is a potentially useful observation for policy makers to consider.

Figure 4: Digital Services Trade Restrictiveness Index, 2020

Table 2: Firm-Level Regression Analyses Summary Table (Significant Correlations, 2014–2019)

Next Steps

In view of developments on digital economy issues at the WTO, OECD and regional levels, it may prove timely to push forward with a broadened policy reform agenda. Here are three potential areas for action:

- The proposed WTO e-commerce deal should be concluded on a priority basis. Areas of convergence may include transparency provisions, consumer protection and e-trade facilitation. A majority of members appears to support permanent duty-free treatment for electronic transmissions. The public policy symbolism of a WTO accord would argue for conclusion of a deal soon, even if more ambitious objectives must be set aside for now. Demonstration of even stepwise progress at the WTO would be beneficial in the face of current geopolitical tensions.

- With respect to digital trade, governments should accede to existing high-standards deals or form new regional and bilateral deals that offer digital market openness with liberal, lean and regulatory guardrails. The additional experience with provisions for free flow of data, non-discrimination for digital products, informed-consumer consent models for privacy protection and source code protection, among others, would help to establish facts on the ground about costs and benefits. This may improve prospects for eventual multilateralization of such elements.

- A consistent, comprehensive and coherent data system should be implemented for the digital economy. Coverage should include digital trade, domestic digital economy activity, and relevant policy, regulations and standards. This should be coordinated by existing international organizations such as the WTO, OECD, UNCTAD and World Bank. Better visibility of developments may promote improved policy coherence and economic decision making. It would be a useful complement to a global governance structure (for example, a Digital Stability Board).16

Enhanced governance can support a dynamic digital economy through a framework for market openness to digital trade, healthy competition and appropriate regulatory guardrails. Given the scale and innovation performance of the international digital economy, its good governance is a matter of global importance.