Eight years ago, when the author started her research on the global expansion of the Chinese internet, few people thought that it even had a global dimension. For a long time, popular media stories have shaped conventional wisdom about the Chinese internet. For many, China is only interested in building a national “intranet” that is sealed by the “Great Firewall,” or a “giant cage” (The Economist 2013) that is unplugged from the international network. This conventional wisdom, however, has become increasingly inadequate — and even misleading — in the face of the growing cyber expansion of China-based entities.

Recently, China’s ambition of building a China-centred global digital infrastructure has become a hotly debated topic in both academic and policy circles. As the author has discussed elsewhere, under the policy slogan of building a “Digital Silk Road” (Shen 2018), China-based internet entities have projected enormous capital into the global cyberspace. For example, China’s e-commerce giant Alibaba, following a record $25 billion1 initial public offering in 2014, spent $1 billion for a controlling stake of Lazada (Purnell and Abkowitz 2016), the biggest e-commerce firm in Southeast Asia. Search engine company Baidu similarly confirmed its 2014 investment in Uber, the US-based ride-sharing company, with some estimating the figure to be around $600 million (Chen 2014). In mid-2016, social media giant Tencent led an investment group to purchase 84 percent of Finnish mobile game maker Supercell for $8.6 billion (Chen, Alpeyev and Nakamura 2016). With market values of $484 billion (Alibaba), $447 billion (Tencent) and $89 billion (Baidu) by mid-2018, these companies had entered the club of the world’s most valuable tech companies (Desjardins 2018), sharing the same stage with American tech giants such as Apple, Amazon, Alphabet and Facebook.

Those significant waves of growth and outward expansion have puzzled many analysts and policy makers. The existing frameworks, which often portrayed the Chinese internet as a state-dominated walled garden, seem to fall short in understanding this new phenomenon.

Instead of assuming the Chinese internet and its growing global adventures are the product of a monolithic authoritarian state, the author argues for a deeper investigation of the diverse forms of interactions between internet companies and state entities. For instance, should telecom equipment manufacturer ZTE, a partially state-owned enterprise, be considered as having closer ties to the Chinese government than Huawei, a private telecom vendor? Or should Alibaba, a company largely owned by foreign capital, be considered as autonomous from the state?

How can we better understand China’s efforts in building a global digital infrastructure? Below are three lessons learned in the past eight years.

First, China’s presence in global cyberspace is by no means a recent phenomenon. In other words, to claim that China has only recently started to “move beyond the ‘Great Firewall’” (Shen 2021) is misleading. Instead, it should be understood in a longer historical framework. For example, Chinese telecom equipment vendor Huawei started its global journey in the late 1990s. Long before the Chinese state even officially announced its “going out” initiative in the mid-2000s, Huawei had already secured its first overseas contract from a Hong Kong company and extended its international reach to Russia. In 2008, Huawei’s overseas revenue accounted for more than 75 percent of its total revenue (Shen 2018), making it officially an international tech giant by revenue distribution. In short, China’s engagement with the global internet has a longer prehistory that is very important to our understanding of its current moves.

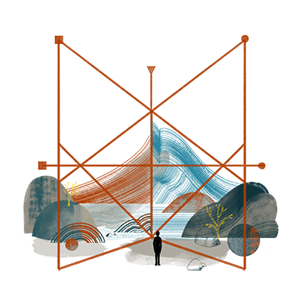

The outward expansion of China’s internet industry is often perceived as a one-dimensional power projection from China to the rest of the world.

Second, it is also important to note that Chinese political and economic entities are not the only architects in building a China-centred international internet. The outward expansion of China’s internet industry is often perceived as a one-dimensional power projection from China to the rest of the world; however, transnational capital has played a far more important role in this process. Alibaba offers an illustrative example in this regard. As the author has discussed in her book Alibaba: Infrastructuring Global China, instead of being a “Chinese” company, Alibaba was once owned primarily by foreign capital, including Japan’s SoftBank and Yahoo (Shen 2021). Furthermore, many transnational investment banks have been the major forces supporting Alibaba’s global shopping spree. For example, in 2015–2016, with help from foreign investment banks such as Citigroup, Deutsche Bank, Goldman Sachs, JP Morgan and Morgan Stanley, Alibaba secured $3 billion (Reuters 2016) in syndicated loans to fund its overseas projects.

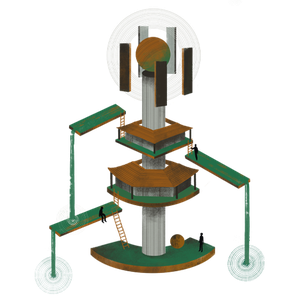

Finally, China’s efforts to build a global digital infrastructure do not represent coherent state-oriented action. Often, we assume that the Chinese internet is dominated by a monolithic authoritarian state that exercises its power over every aspect of the Chinese digital economy. However, the author’s research has shown that there are complicated forms of power struggles among different government entities and units of internet capital across hardware, network and application layers. For example, led by equipment vendors such as Huawei, ZTE, Lenovo and Xiaomi, companies in the hardware layer are the pioneers in constructing China’s global digital infrastructure. Over the years, they have generally enjoyed generous financial and diplomatic support from the state to expand their reach to many of the Global South countries. However, in certain cases, they may need to distance themselves from the Chinese agenda due to the growing tension in the geopolitics of the internet as well as their increasingly internationalized business scope and profit strategies. For instance, in 2015, a Huawei executive expressed his concerns about the trade implications of China’s then newly formulated information security laws, worrying that the policies would have adverse effects on global trade openness and Huawei’s own internationalization plans (Shih 2015).

A global digital China is rising. This process, however, is complicated and multifaceted, demanding a longer historical perspective and a structural understanding of the transformation of the global internet. Instead of viewing China’s efforts as simply dominated by state strategies, we need to constantly remind ourselves that the priorities and interests of many China-based digital entities are not always in line with the Chinese state. It is important, therefore, to move beyond the abstract “great power competition” (He and Shen 2021) to more closely monitor what is actually happening on the ground in the construction of China’s global digital infrastructure. Will the future structure of the global internet be significantly shaped by China-based business actors across hardware, network and application layers? If so, for whom and to which ends?